Results

#1. The entry Public Health and Sanitation is included in the Constitution of India in:

#2. Financial distribution between the Union and the States takes place on the basis of the recommendations of which one of the following?

#3. Fiscal Deficit is:

#4. The recommendations of the Sarkaria Commission relate to:

#5. Which one of the following expenditures is NOT charged on the Consolidated Fund of India?

#6. ‘Marriage’, ‘Divorce’ and ‘Adoption’ are an entry in the seventh schedule of the Constitution under the following:

#7. States in Indian Union will receive at last what part of the following percentage of Central Tax under 15th Finance Commission recommendations?

#8. For which purpose is the Finance Commission appointed ?

#9. With reference to the Constitution of India, which one of the following pairs is NOT correctly matched ? Subject : List

#10. All revenues received by the Union Government by way of taxes and other receipts for the conduct of Government business are credited to the:

#11. Which one of the following is not related to Union-State relations in India ?

#12. Which one of the following subjects is under the Union List in the Seventh Schedule of the Constitution of India ?

#13. In which list does the Union Government enjoy exclusive powers?

#14. The Finance Commission is constituted under Article _______ of the Constitution of India.

#15. Which one of the following is NOT included in the State List in the Constitution of India?

#16. Which one of the following is the subject of Concurrent List?

#17. Which one of the following forms the largest share of deficit in Government of India Budget:

#18. What is the period covered by the recommendation of the 15th Finance Commission?

#19. The first finance commission was constituted in:

#20. In which one of the following does the subject of Co-operative Societies fall?

#21. Which of the following subjects lies in the Concurrent List?

#22. The recommendations of the Kelkar Task Force relate to:

#23. The distribution of finances between Centre and States is done on the recommendation of:

#24. Article 249 of the Indian Constitution deals with-

#25. Finance Commission is :

#26. Which one of the following Articles of the Constitution of India says that the executive power of every State shall be so exercise as not to impede or prejudice the exercise of the executive power of the Union ?

#27. Which one of the following statements appropriately describes the ‘Fiscal Stimulus’?

#28. Consider the following statements : The function(s) of the Finance Commission is / are : 1. to allow the withdrawal of the money out of the Consolidated Fund of India. 2. to allocate between the states the shares of proceeds of taxes. 3. to consider the application for grants-in-aid from States. 4. to supervise and report on whether the Union and State Governments are levying taxes in accordance with the budgetary provisions. Which of these statements is/are correct?

#29. Under which Article of the Constitution of India can the Indian Parliament make laws under the residuary powers?

#30. Centre-State relations in India are dependent upon: 1. Constitutional provisions 2. Conventions and practices 3. Judicial interpretations 4. Mechanics for dialogue Select the correct answer from the codes given below:

#31. The Indian Parliament cannot legislate on a subject of State List unless: 1. The President of India directs it to do so. 2. The Rajya Sabha passes a resolution that it is necessary to do so in national interest. 3. The Speaker of the Vidhan Sabha certifies that the legislation is necessary. 4. There is a national emergency. Considering the above statements, select the correct answer from the codes given below:

#32. Who is the Chairman of the 15th Finance Commission?

#33. The Finance Commission-

#34. For distribution of powers between the Union and the States, the Constitution of India introduces three lists. Which two of the following Articles govern the distribution of powers:

#35. The Finance Commission is primarily concerned with recommending to the President about:

#36. The Union Parliament can also legislate on a subject of State List: 1. To give effect to international agreement. 2. With the consent of the State concerned. 3. During the President’s rule in the State. 4. In the national interest, when Rajya Sabha passes a resolution to this effect by a 2/3rd majority. Select the correct answer from the codes given below:

#37. The Vice Chairperson of NITI Aayog:

#38. The authorization for the withdrawal of funds from the Consolidated Fund of India must come from :

#39. Which of the following are the methods of Parliamentary control over public finance in India? 1. Placing Annual Financial Statement before Parliament. 2. Withdrawal of money from Consolidated Fund of India only after passing the Appropriation Bill. 3. Provisions of supplementary grants and vote-on accounts. 4. A periodic or at least a mid-year review of programmes of the Government against macroeconomic forecasts and expenditure by a Parliamentary Budget Office. 5. Introducing the Finance Bill in the Parliament. Select the correct answer using the codes given below:

#40. Fiscal policy refers to :

#41. The largest item of expenditure in the current account of the Central Government Budget is-

#42. The President of India by order constitutes a Finance Commission every-

#43. When the Annual Union Budget in NOT passed by the Lok Sabha:

#44. Who is the Chairman of the Second Administrative Reforms Commission?

#45. When will demand become a grant?

#46. Fiscal responsibility and Budget Management Act was enacted in India in the year:

#47. Recommendations to the President of India on the specific Union-State fiscal relations are made by the:

#48. Which of the following is/are the function/functions of the Finance Commission of India? 1. Distribution of the taxes which are divisible between the Union and the States. 2. To recommend the principles which should govern the grant-in-aid of the revenues of the States out of the Consolidated Fund of India. Select the correct answer using the code given below-

#49. Consider the following statements with reference to mutual delegation of functions between Centre and states:

1. Centre can delegate both legislative and executive powers to the states.

2. Mutual delegation of administrative functions may be conditional or unconditional.

3. President can delegate executive functions to the states without latter’s consent.

4. State Legislature may, with the consent of the Central government, delegate to them any of the executive functions of the state.

Which of the statements given above is/are correct?

Statement 1 is incorrect. The distribution of legislative powers between the Centre and the states are rigid. Consequently, the Centre cannot delegate its legislative powers to the states and a single state cannot request the Parliament to make a law on a state subject. Whereas Constitution provides for intergovernmental delegation of executive functions between the Centre and the states.

Statement 2 is correct. The mutual delegation of administrative functions may be conditional or unconditional.

Statement 3 is incorrect. The Constitution also makes a provision for the entrustment of the executive functions of the Centre to a state without the consent of that state. But, in this case, the delegation is by the Parliament and not by the president.

Statement 4 is incorrect. Governor of a state may, with the consent of the Central government, entrust to that government any of the executive functions of the state. The State Legislature cannot delegate executive function of the state to the central government.

#50. Consider the following statements with reference to All India Services:

1. A member of the All-India Services cannot become member of any service associations whether recognised or unrecognised.

2. Th e Centre cannot take action against civil service offi cials who are posted under the state government without the latter’s permission.

Which of the statements given above is/are correct?

Statement 1 is incorrect. The position in India is that the civil servants cannot become members of any service association which is not recognised by the Government. Thus, joining an unrecognised association is a disciplinary off ence. But at the same time civil servants can become members of associations recognised by the government.

Statement 2 is correct. The Centre cannot take action against civil service officials who are posted under the state government, unless the latter agrees.

#51. With reference to the socially and educationally backward classes (SEBCs) in India, consider the following statements:

1. States can prepare their own list of socially and educationally backward classes.

2. The list of socially and educationally backward classes prepared by the states cannot differ from the Central list.

3. Only the Parliament may notify the Central list of socially and educationally backward classes.

4. Union Territories must consult the National Commission for Backward Classes while preparing their list of socially and educationally backward classes.

Which of the following statements given above is/are correct?

The Constitution (105th Amendment) Act seeks to clarify some provisions in the 102nd Constitutional Amendment Act to restore the power of the states and Union territories to prepare their own list of socially and educationally backward classes.

Statement 1 is correct. The Constitution (105th Amendment) Act enables states and union territories to prepare their own list of socially and educationally backward classes. Th is list must be made by law.

Statement 2 is incorrect. The Constitution (105th Amendment) Act provides that the list made by states and union territories can differ from the central list.

Statement 3 is incorrect. The Constitution (One Hundred and Second Amendment) Act, 2018 gave constitutional status to the NCBC, and empowered the President to notify the list of socially and educationally backward classes for any state or union territory for all purposes. The 2021 amendment act amends this to provide that the President may notify the list of socially and educationally backward classes only for purposes of the central government. This central list will be prepared and maintained by the central government.

Statement 4 is incorrect. Article 338B of the Constitution mandates the central and state governments to consult the NCBC on all major policy matters affecting the socially and educationally backward classes. The Constitution (One Hundred and Twenty-seventh Amendment) Bill, 2021 exempts states and union territories from this requirement for matters related to preparation of their list of socially and educationally backward classes.

#52. Consider the following statements:

1. Only Union Government can legislate on matters of prevention of the extension of infectious diseases from one State to another.

2. Under the Disaster Management Act, 2005, all powers to deal with a disaster are vested in the Central government.

3. The Epidemic Diseases Act, 1897, empowers state governments to prescribe regulations to prevent the spread of a disease.

Which of the statements given above is/are correct?

Statement 1 is incorrect: The subject ‘prevention of the extension from one State to another of infectious or contagious diseases or pests affecting men, animals or plants’ is included in the Concurrent List under the Constitution of India. Hence, both central and state government are empowered to legislate on this matter.

Statement 2 is incorrect: The Disaster Management Act, 2005, clearly defines the powers of the Central government, states, and districts. The law authorizes the NDMA’s chairperson, the Prime Minister, to take decisions to deal with the pandemic, including deciding on relief for victims and special measures for the needy. The state chief minister may also invoke special powers under the law for dealing with the pandemic. It also gives powers to the local authorities to act swiftly in line with the national plan and state plans to control the impacts of a disaster.

Statement 3 is correct: The Epidemic Diseases Act, 1897, empowers a state government to prescribe temporary regulations to be observed by the public or any person to prevent the outbreak and spread of a disease. Recently various states have invoked the EDA, 1897, to pass orders and guidelines on social distancing measures, closure of establishments and limitation on activity.

#53. Consider the following statements with reference to the grants-in-aid to the states:

1. Statutory grants are provided to every state.

2. Discretionary grants can be given for any public purpose, even beyond the legislative competence of the Centre.

3. Constitution also provides for specific grants for raising the level of administration of the scheduled areas.

Which of the statements given above is/are correct?

Statement 1 is incorrect. Article 275 empowers the Parliament to make statutory grants to the states which are in need of financial assistance and not to every state. These sums are charged on the Consolidated Fund of India every year. The statutory grants under Article 275 (both general and specific) are given to the states on the recommendation of the Finance Commission.

Statement 2 is correct. Article 282 empowers both the Centre and the states to make any grants for any public purpose, even if it is not within their respective legislative competence. Under this provision, the Centre makes grants to the states. These grants are also known as discretionary grants, the reason being that the Centre is under no obligation to give these grants and the matter lies within its discretion. These grants have a two-fold purpose: to help the state financially to fulfil plan targets; and to give some leverage to the Centre to influence and coordinate state action to effectuate the national plan.

Statement 3 is correct. Apart from the general provision in statutory grant, the Constitution also provides for specific grants for promoting the welfare of the scheduled tribes in a state or for raising the level of administration of the scheduled areas in a state including the State of Assam

#54. Consider the following statements in the context of Doctrine of Colourable Legislation:

1. It holds that the union and state legislatures should not encroach upon each other’s domain.

2. The courts will look into the object of the law and not motives of the legislatures while deciding on its validity.

3. State legislature is barred from re-enacting the same law if the statute is found to be invalid due to legislative incompetence.

Which of the statements given above is/are correct?

Statement 1 is incorrect. The doctrine of colourable legislation is based on the maxim that what one cannot do directly, that cannot be done indirectly. It is applied when the state legislatures have transgressed their power as mentioned in the Constitution while enacting a law. It is also characterized as a fraud on the Constitution because no legislature can violate the Constitution by employing an indirect method. The doctrine of Pith and Substance holds that the union and state legislatures should not encroach upon each other’s domain.

Statement 2 is correct. The court will look into the true nature and character of the legislation and for that its object, purpose or design to make law on a subject is relevant and not its motive. If the law enacted by the legislature is found in substance and in reality, beyond the competence of the legislature enacting it, it will be ultra vires and void, even though it apparently purports to be within the competence of the legislature enacting it. It is the substance of the Act that is material and not merely the form or outward appearance.

Statement 3 is incorrect. Further, if a statute is found to be invalid on the ground of legislative incompetence, it does not permanently inhibit the legislature from re-enacting the same if the power to do so is properly traced and established. In such a situation, it cannot be said that subsequent legislation is merely a colourable legislation or a camouflage to re-enact the invalidated previous legislation.

#55. In India, under which of the following circumstances can Parliament make Legislations on State subjects?

1. When Rajya Sabha passes a resolution supported by 2/3rd of the members present.

2. When a proclamation of National Emergency is in operation.

3. When a State passes a resolution to that effect.

4. To give effect to international agreements, treaties and conventions.

Select the correct answer using the code given below:

Statement 1 is correct. The Parliament can make laws on the subjects enumerated in the State List if the Rajya Sabha declares that it is necessary in the national interest that Parliament should make laws on that matter. Such a resolution must be supported by two-thirds of the members present and voting.

Statement 2 is correct. The Parliament can make laws on the subjects enumerated in the State List when a proclamation of National Emergency is in operation. Such laws become inoperative on the expiration of six months after the emergency has ceased to operate.

Statement 3 is incorrect. The Parliament can make laws on the subjects enumerated in the State List when two or more states make a joint request to the Parliament. A law so enacted applies only to those states which have passed the resolutions.

Statement 4 is correct. The Parliament can make laws on the subjects enumerated in the State List to give effect to international agreements, treaties and conventions.

#56. Consider the following statements:

1. Parliament can make extraterritorial legislation.

2. Acts of parliament cannot be modified by executive in case of any Union Territories.

Which of the statements given above is/are correct?

Statement 1 is correct- The Parliament can make laws for the whole or any part of the territory of India. The territory of India includes the states, union territories, and any other area for the time being included in the territory of India. The Parliament alone can make ‘extraterritorial legislation’. Thus, the laws of the Parliament are also applicable to the Indian citizens and their property in any part of the world.

Statement 2 is incorrect- The Constitution places certain restrictions on the plenary territorial jurisdiction of the Parliament. The President can make regulations for the peace, progress and good government of certain Union Territories. A regulation so made has the same force and effect as an act of Parliament. It may also repeal or amend any act of Parliament in relation to these union territories.

#57. The Constitution has laid down provisions to protect the interest of the states. As part of such provisions, which of the following bills need prior recommendation of the President before being introduced in the Parliament?

1. A bill which changes the meaning of ‘agriculture income’.

2. A bill which imposes any surcharge on any tax.

3. A bill which varies any tax in which states are interested.

Select the correct answer using the code given below:

Statement 1 is correct. The constitution provides that a bill which varies the meaning of the expression ‘agriculture income’ as defined for the purpose of enactments relating to Indian income tax can be introduced in Parliament only after the recommendation of President.

Statement 2 is correct. As part of this financial protection a bill which imposes any surcharge on any tax or duty for the purpose of Centre needs President’s recommendation.

Statement 3 is correct. A bill which imposes or varies any tax or duty in which states are interested also needs President’s recommendation before being introduced in Parliament.

#58. With respect to effect of various emergencies on financial relations of centre-state, which of the following statements is/are correct?

1. During a national emergency, President can reduce or cancel the transfer of finances from centre to the states.

2. Just like national emergencies, the salaries and allowances of high court judges cannot be reduced during financial emergency.

Select the correct answer using the code given below:

Statement 1 is correct. During the national emergency, President can either reduce or cancel the transfer of finances (both tax sharing and grants-in-aid) from centre to the states. Such modification continues till the end of financial year in which emergency ceases to operate.

Statement 2 is incorrect. During the financial emergency, centre can give directions to states to reduce the salaries and allowance of all class of persons serving in the state including the high court judges.

#59. With reference to taxing power in India which of the following statements is/are correct?

1. State legislature has more subjects to levy tax in comparison to Parliament.

2. Profession tax levied on any person under the state list should not exceed 2500 per annum.

3. Wealth tax or expenditure tax can be imposed by Parliament under the union list.

Select the correct answer using the code given below:

Statement 1 is correct. State legislature has exclusive power to levy taxes on subjects, which are 20 in number, enumerated in the state list. On the other had union list has 15 subjects and concurrent list has only 3 subjects on which tax can be levied.

Statement 2 is correct. A state legislature can impose taxes on professions, trades, callings and employments. But the total amount of such taxes payable by any person should not exceed 2500 per annum.

Statement 3 is incorrect. Parliament has imposed gift tax, wealth tax and expenditure tax under the residuary power of taxation. Under this Parliament is vested with power to impose taxes not enumerated in any of the three lists.

#60. Consider the following statements:

1. The states have no share in the proceeds of surcharge imposed by the Parliament.

2. Comptroller and Auditor General (CAG) is the final authority to certify net proceeds of any tax.

Which of the statements given above is/are correct?

Statement 1 is correct. Article 271 provides that Parliament can levy surcharge on some taxes and duties. It also provides that the proceeds of surcharges go to the centre exclusively and states have no share in it.

Statement 2 is correct. Under Article 279, CAG ascertains and certifies the net proceeds of any tax or duty. His/her certificate in this matter is final.

#61. With reference to concurrent list under Schedule 7 of the Indian constitution, consider the following statements:

1. A law made on a subject by state under the list which has got assent from the President prevail over the Parliament’s law made on the same subject.

2. 42nd constitutional amendment led to decrease in the number of subjects under the concurrent list.

Which of the statements given above is/are correct?

Statement 1 is correct. As per Article 254(2), if centre and state have made a law on the same subject then the formers prevail. But if the state law has received assent of the President than it prevails over the central law. Parliament can override such state law by a subsequent legislation.

Statement 2 is incorrect. Originally concurrent list had 47 subjects which grew up to 52 by the 42nd constitutional amendment (it increased the number of subjects).

#62. Arrange the following in the chronological order according to the year of their establishment:

1. Anandpur Sahib Resolution

2. Punchhi Commission

3. Rajmannar Committee

4. Sarkaria Commission

Select the correct answer using the code given below:

Option 1: Anandpur Sahib Resolution, 1973: It demanded that the authority of the Centre should be confined only to the defense of the country, foreign relations, communications, railways and currency. All the residuary subjects should be under the jurisdiction of states.

Statement 2: Punchhi Commission, 2007: The Government of India constituted a Commission on Centre-State Relations to look into the new issues of Centre-State relations keeping in view the changes that have taken place in the polity and economy of India..

Statement 3: Rajmannar Committee, 1969: A CentreState Relations Inquiry Committee was set up by the then state Government of Tamil Nadu

Statement 4: Sarkaria Committee, 1983: Sarkaria Commission was set up to examine the relationship and balance of power between state and central governments and suggest changes within the framework of the Constitution.

#63. Consider the following statements:

1. The Government of India Act of 1935 provided for two-fold enumeration of legislative subjects viz, federal and provincial.

2. Under the Government of India Act of 1935, the residuary powers of legislation were given to the governor-general of India.

3. As per the present Constitution of India, the residuary powers of legislation are vested with parliament.

Which of the statements given above is/are correct?

Statement 1 is incorrect. The Government of India Act of 1935 provided for a three-fold enumeration, viz., federal, provincial and concurrent.

Statement 2 is correct. Under the Government of India Act of 1935, the residuary powers were given neither to the federal legislature nor to the provincial legislature but to the governor-general of India.

Statement 3 is correct. As per the present Constitution of India, the power to make laws with respect to residuary subjects (i.e., the matters which are not enumerated in any of the three lists) is vested in the Parliament. This residuary power of legislation includes the power to levy residuary taxes.

#64. Consider the following pairs of subjects and the lists in which they are mentioned under the Seventh Schedule:

Which of the pairs given above are incorrectly matched?

Pair 1 is incorrectly matched. The subject public health and sanitation come under the State List.

Pair 2 is incorrectly matched. The subject labour welfare comes under the Concurrent List.

Pair 3 is correctly matched. The subject drugs come under the Concurrent List.

Pair 4 is correctly matched. The subject insurance come under the Union List. c.

#65. The Rajya Sabha can pass a resolution by which the Parliament becomes competent to make laws on a matter in the State List. With reference to this, consider the following statements:

1. President’s recommendation is necessary to introduce such a resolution.

2. The resolution must be supported by two-thirds of the members present and voting.

3. Th e resolution remains in force for one year and can be renewed any number of times.

Which of the statements given above is/are correct?

Statement 1 is incorrect. If the Rajya Sabha declares that it is necessary in the national interest that Parliament should make laws with respect to goods and services tax or a matter in the State List, then the Parliament becomes competent to make laws on that matter. President’s recommendation is not necessary to introduce such a resolution.

Statement 2 is correct. Such a resolution must be supported by two-thirds of the members present and voting. This provision does not restrict the power of a state legislature to make laws on the same matter. But, in case of inconsistency between a state law and a parliamentary law, the latter is to prevail.

Statement 3 is correct. The resolution remains in force for one year and can be renewed any number of times but not exceeding one year at a time. The laws cease to have effect on the expiration of six months after the resolution has ceased to be in force.

#66. Two or more states can pass resolutions requesting the Parliament to enact laws on a matter in the State List. With reference to such a law made by the Parliament, which of the statements given below is incorrect?

Statement a is correct. Two or more states can pass resolutions requesting the Parliament to enact laws on a matter in the State List. A law so enacted applies only to those states which have passed the resolutions. However, any other state may adopt it aft erwards by passing a resolution to that effect in its legislature.

Statement b is incorrect. The bill to give effect to such a law can be initiated in any house of the parliament. Such a law can be amended or repealed only by the Parliament and not by the legislatures of the concerned states.

Statement c is correct. The effect of passing a resolution under the above provision is that the Parliament becomes entitled to legislate with respect to a matter for which it has no power to make a law. On the other hand, the state legislature ceases to have the power to make a law with respect to that matter.

Statement d is correct. Wild Life (Protection) Act of 1972 was passed under this provision. Other important acts passed under this provision are – Prize Competition Act, 1955, Water (Prevention and Control of Pollution) Act, 1974, Urban Land (Ceiling and Regulation) Act, 1976, Transplantation of Human Organs Act, 1994.

#67. Consider the following statements:

1. A prior sanction of the President is needed to introduce a bill in the state legislature which imposes restrictions on the freedom of trade and commerce.

2. The President enjoys absolute veto over a state bill reserved by the governor for the president’s consideration.

Which of the statements given above is/are correct?

Statement 1 is correct. The Constitution empowers the Centre to exercise control over the state’s legislative matters. Bills on certain matters, like imposing restrictions on the freedom of trade and commerce, enumerated in the State List can be introduced in the state legislature only with the previous sanction of the president.

Statement 2 is correct. The governor can reserve certain types of bills passed by the state legislature for the consideration of the President. The president enjoys absolute veto over them. It means that the President can withhold his assent to such a bill passed by the state legislature. The bill then ends and does not become an act.

#68. Consider the following statement regarding the financial powers of the parliament and state legislatures:

1. Parliament as well as state legislatures can make laws governing goods and services tax.

2. A State legislature can impose tax on the consumption or sale of electricity.

3. The property of the union and state is exempted from state taxation and Union taxation respectively.

Which of the statements given above is/are correct?

Statement 1 is correct. The 101st Constitutional Amendment Act of 2016 has made a special provision with respect to goods and services tax. It has conferred concurrent power upon Parliament and State Legislatures to make laws governing goods and services tax.

Statement 2 is correct. A state legislature can impose tax on the consumption or sale of electricity. But no tax can be imposed on the consumption or sale of electricity which is (a) consumed by the Centre or sold to the Centre; or (b) consumed in the construction, maintenance or operation of any railway by the Centre.

Statement 3 is correct. The property of union is exempted from all taxes by a State or by any authority within a state except Parliament may be law otherwise provide. Conversely, the property and income of state shall be exempt from Union taxation except if the state enters into trade or business other than the trade or business declared by Parliament shall not be exempt from Union taxation.

#69. If taxes on agricultural income are introduced in India, then as per the Constitution, such taxes would be:

Taxes enumerated in the state list are levied, collected and retained by the states. For example: Taxes on agriculture income are levied, collected and retained by the states.

#70. Consider the following statements:

1. The Central government can give guarantees in respect of loans raised by any state.

2. Unlike Government of India Act 1935, the Constitution of India do not allow states to borrow from outside India.

Which of the statements given above is/are correct?

Statement 1 is correct. The Central government can make loans to any state or give guarantees in respect of loans raised by any state. Any sums required for the purpose of making such loans are to be charged on the Consolidated Fund of India.

Statement 2 is correct. State cannot borrow outside India. Under the Government of India Act,1935, the states had the power to borrow outside India with the consent of the centre. But this power is totally denied to the states by the Constitution

#71. Consider the following statements:

1. The corporations or the companies created by the Central government are immune from state taxation.

2. The property and income of local authorities situated within a state are not exempted from the Central taxation.

Which of the statements given above is/are correct?

Statement 1 is incorrect. As corporations or the companies created by the Central government are separate legal entities, they are not immune from state or local taxation. At the same time, the property of Centre is exempted from all taxes imposed by a state or any authority within a state like municipalities, district boards, panchayats and so on. But the Parliament is empowered to remove this ban.

Statement 2 is correct. The property and income of local authorities situated within a state are not exempted from the Central taxation.

#72. The Constitution, under Schedule 5, provides for restriction or modification of an act of Parliament in a scheduled area. Such a notification can be passed by:

The Constitution defines the territorial limits of the legislative powers vested in the Centre and the states. Under the provisions of Fifth Schedule of the Constitution, the governor is empowered to direct that an act of Parliament does not apply to a scheduled area in the state or apply with specifie modifications and exceptions.

#73. Consider the following statements:

1. Parliament can make a law on a subject in the State List to implement an international treaty.

2. Union government can give directions to the state to declare National highways or waterways.

Which of the statements given above is/are correct?

Statement 1 is correct. Article 253 of the Constitution allows Parliament to make any law for the whole or any part of the territory of India for implementing any treaty, agreement or convention with any other country or countries. Parliament can even make a law on a subject in the State List to implement such an agreement or a treaty.

Statement 2 is correct. Union government can give directions to the state for declare National highways or waterways.

#74. Consider the following statements:

1. Ordinarily the executive function with respect to matters included under Concurrent List would rest with the States.

2. Centre has only a power to give directions to state to execute a central law relating to a Concurrent subject.

Which of the statements given above is/are correct?

Statement 1 is correct. The executive function of matters included in the Concurrent Legislative list shall ordinarily remain with the states, but subject to the provisions of the Constitution or of any law of Parliament conferring such function expressly upon the Union.

Statement 2 is incorrect. Unlike Government of India Act, 1935, the centre had only a power to give directions to States. But the Constitution provides that the Union may, whenever it thinks fit, itself take up the administration of Union laws relating to any Concurrent subject.

#75. In the context of the Legislative relations between Centre and State consider the following statements:

1. Matters in which uniformity of legislation throughout the Union is essential are included under Union list.

2. Matters in which uniformity of legislation is desirable but not essential are included under State list.

3. Matters which allow for diversity of interest and treatment are included in the Concurrent list.

Which of the statements given above is/ are correct?

Statement 1 is correct. The Union List consists of subjects which are of common interest to the Union and with respect to which uniformity of legislation throughout the Union is essential.

Statement 2 is incorrect. Subjects which allow for diversity of interest and treatment are included in the State list.

Statement 3 is incorrect. Matters in which uniformity of legislation throughout the Union is desirable but not essential are included in the Concurrent list

#76. With reference to Constitutional provisions with regard to borrowing, consider the following statements:

1. Parliament can fix limits on the external borrowing that can be undertaken by the Central government.

2. A state government always requires consent of the Centre to raise loans within India.

Which of the statements given above is/are correct?

Statement 1 is correct. The Parliament under Article 292 can fix limits on both internal and external borrowing of the Central Government. However, no such law has so far been enacted by the Parliament.

Statement 2 is incorrect. Only when there is still outstanding part of a loan made to the state by the Centre or in respect of which a guarantee has been given by the Centre, the state would require consent of the Centre before raising any loan. If neither of the above situations exist, the state would not need the consent of the Centre.

#77. Consider the following statements:

1. The grants under Article 275 are given to the states on the recommendation of the Finance Commission.

2. The grants under Article 282 empowers the Centre to make any grants for any public purpose, even if it is not within its legislative competence.

Which of the statements given above is/are incorrect?

Statement 1 is correct. Statutory Grants- Article 275 empowers the Parliament to make grants to the states which are in need of financial assistance and not to every state. The statutory grants under Article 275 (both general and specific) are given to the states on the recommendation of the Finance Commission.

Statement 2 is correct. Discretionary Grants -Article 282 empowers both the Centre and the states to make any grants for any public purpose, even if it is not within their respective legislative competence. Under this provision, the Centre makes grants to the states.

#78. Consider the following pairs:

Which of the pairs given above is/are correctly matched?

The constitution provides for a detailed mechanism for distribution of tax revenues between the centre and the states.

Pair 1 is correctly matched: Taxes Levied by the Centre but Collected and Appropriated by the States (Article 268): This category includes the stamp duties on bills of exchange, cheques, promissory notes, policies of insurance, transfer of shares and others.

Pair 2 is correctly matched and 4 is incorrectly matched.: Taxes Levied and Collected and Retained by the States: They are enumerated in the state list. These includes taxes like land revenue; taxes on agricultural income; taxes on lands and buildings, taxes on vehicles; tolls taxes; taxes on professions, trades, callings and employments, and capitation taxes.

Pair 3 is incorrectly matched: Taxes Levied and Collected by the Centre but Assigned to the States (Article 269): The following taxes fall under this category: (i) Taxes on the sale or purchase of goods (other than newspapers) in the course of inter-state trade or commerce. (ii) Taxes on the consignment of goods in the course of inter-state trade or commerce.

#79. Article 275 empowers the Parliament to make grants to the states which are in need of financial assistance. These grants are not given to every state and are charged on the Consolidated Fund of India. A unique feature of these grants is that they are given to states on the recommendation of Finance Commission. Which of the following type of grant has been discussed above?

Statutory Grant: Article 275 empowers the Parliament to make grants to the states which are in need of financial assistance and not to every state. Also, different sums may be fixed for different states. These sums are charged on the Consolidated Fund of India every year. Apart from this general provision, the Constitution also provides for specific grants for promoting the welfare of the scheduled tribes in a state or for raising the level of administration of the scheduled areas in a state including the State of Assam.

The statutory grants under Article 275 (both general and specific) are given to the states on the recommendation of the Finance Commission.

#80. With reference to the territorial extent of Parliament and state legislatures, consider the following statements:

1. The Parliament of India can make laws for the whole or any part of the territory of India.

2. The laws made by state legislatures are not applicable to any person residing outside the territorial limit of the state in any case.

3. The laws made by state legislatures can be made applicable to Indian Citizens and their property in any part of the world.

Which of the statements given above is/are incorrect?

Statement 1 is correct: The Parliament of India can make laws for the whole or any part of the territory of India. The territory of India may include the states, the union territories, and any other area for time being included in the territory of India.

Statement 2 is incorrect: The laws made by the state legislature are not applicable outside the state, except when there is a sufficient nexus between the states and the object. e.g., Criminal Laws of Haryana will be applicable on a person who is a resident of other state, but committed crime within the territorial jurisdiction of Haryana.

Statement 3 is incorrect: Parliament alone can make ‘extra-terrestrial legislation’. The laws of parliament are also applicable to the Indian Citizens and their property in any part of the world.

#81. Consider the following statements: –

1. The President of India can repeal or amend any act of Parliament in relation to Andaman and Nicobar and Lakshadweep.

2. The governor of a state is empowered to direct that an act of Parliament does not apply to a scheduled area in the state.

Which of the statements given above is/are correct?

Statement 1 is correct: The President can make regulations for the peace, progress and good government of the five Union Territories which includes the Andaman and Nicobar Islands, Lakshadweep, Dadra and Nagar Haveli, Daman and Diu and Ladakh. A regulation so made has the same force and effect as an act of Parliament. It may also repeal or amend any act of Parliament in relation to these Union Territories.

Statement 2 is correct: The Governor of a state is empowered to direct that an act of Parliament does not apply to a scheduled area in the state or apply with specified modifications and exceptions. Similarly, the Governor of Assam may direct that an act of Parliament does not apply to a tribal area (autonomous district) in the state or apply with specifi ed modifications and exceptions. The President enjoys the same power with respect to tribal areas (autonomous districts) in Meghalaya, Tripura and Mizoram.

#82. Consider the following statements:

1. A state while exercising its executive power must ensure compliance with the laws made by the Parliament.

2. Only the central government has the executive power of implementing a law made by the Parliament on any matter enumerated in Concurrent List.

Which of the statements given above is/are correct?

Statement 1 is correct. The executive power has been divided between the Centre and the states on the lines of the distribution of legislative powers. The Constitution has placed two restrictions on the executive power of the states in order to give ample scope to the Centre for exercising its executive power in an unrestricted manner. It says that the executive power of every state is to be exercised in such a way (a) as to ensure compliance with the laws made by the Parliament and any existing law which apply in the state; and (b) as not to impede or prejudice the exercise of executive power of the Centre in the state.

Statement 2 is incorrect. In respect of the matters mentioned in concurrent list, both parliament and state legislature have the power to legislate, but the executive power rests with the state except when a constitutional provision or a parliamentary law specifically confers it on Centre. Therefore, a law on a concurrent subject, though enacted by the Parliament, is to be executed by the states except when the Constitution or the Parliament has directed otherwise.

#83. Which of the following matters come under residuary powers as per Schedule VII of the Indian Constitution?

1. Computer Software

2. Disaster Management

3. Currency and Coinage

4. Foreign Affairs

Select the correct answer using the code given below:

The Constitution provides for a three-fold distribution of legislative subjects between the Centre and the states, viz., List-I (the Union List), List-II (the State List) and List-III (the Concurrent List) in the Seventh Schedule.

Option 1 and 2 are correct. Disaster management and computer software as a field of legislation does not find mention in either List II or List III, nor does any particular entry in List I specifically deal with this. Therefore, it falls under residuary powers.

Option 3 and 4 are incorrect. Currency and coinage and foreign affairs come under Union List.

Residuary powers, put simply, refer to the power of jurisdiction upon subjects that are not mentioned in the state or concurrent list. The union government enjoys exclusive jurisdiction over such subjects.

Article 248 of the constitution clearly states, “The Union Parliament has exclusive power to make any law with respect to any matter not enumerated in the Concurrent List or the State List.”

#84. Receipts from which of the following are the major sources of non-tax revenues of the states?

1. Receipts from fisheries

2. Excise duties on liquor

3. Royalties from mines

4. Receipts from forests

5. Receipts from State PSEs (Public Sector Enterprises)

Select the correct answer using the code given below:

Tax revenue is charged on income earned by an individual or an entity (direct tax) and on the value of transaction of goods and services (indirect tax). On the other hand, non-tax revenue is charged against services provided by the government. It also includes interest charged on loans advanced by the government for various purposes. It is compulsory to pay a part of the income earned/generated and amount of goods and services consumed as tax. However, non-tax revenue becomes payable only when services offered by the government are availed.

Option 1, 3, 4 and 5 are correct. The major sources of non-tax revenues of the state are all receipts other than taxes and capital receipts from debt issues or asset sales. Fees charged by state government for particular services and commodities provided by it, forms a major nonrevenue source of income for the state government. For example, the receipts from irrigation, forests, Fisheries, State Public sector enterprises and escheat and lapse, royalties from mines and mineral concession fees.

Option 2 is incorrect. Excise duty on alcohol is the tax source of revenue for the states, and not a non-tax revenue.

#85. Consider the following statements regarding various grants provided to states:

1. Statutory grants are made compulsorily for every state but discretionary grants are not.

2. Statutory grants are made by the Parliament, whereas discretionary grants are made by the Central government.

3. Specific grants needed for promoting the welfare of Scheduled Tribes in a state are considered as discretionary grants.

Which of the statements given above is/are incorrect?

Statement 1 is incorrect. Article 275 of Constitution of India provides for statutory grants to those states which are in need of financial assistance and not to every state. Moreover, different sums are charged for different states. Discretionary grants are the grants provided by the centre and states under Article 282 for any public purpose even if it is not in their legislative competence. The centre is under no obligation to give this grant to states, rather it is centres discretion to allocate this grant. Thus, both statutory and discretionary grants are not compulsorily given to all states.

Statement 2 is correct. Statutory grants are made by the Parliament on the recommendation of Finance Commission. While the Discretionary grants are made by the Centre as well as by the states on their discretion.

Statement 3 is incorrect. Specific grants needed for promoting the welfare of Scheduled tribes in a state are considered as statutory grants. Moreover, grants for raising the level of administration of the scheduled areas in a state including in the state of Assam is also considered in the category of statutory grants.

#86. Which the following bills can be introduced in the Parliament only on the recommendation of the President?

1. Constitutional amendment bills

2. A bill which varies the meaning of the expression “agricultural income” for Indian Income tax.

3. Finance bill –II under Article 117 (3)

4. A bill diminishing the area of state

5. A bill imposing any surcharge on a tax for the purpose of centre.

Select the correct answer using the code given below:

Option 1 is incorrect. Constitutional amendment bills do not require prior permission of President for its introduction in Parliament.

Option 2 is correct. A bill which varies the meaning of the expression “agricultural income” for the purpose of enactment relating to Indian Income tax requires prior permission of President.

Option 3 is incorrect. Financial Bills-I under Article 117 (1) are like money bills which requires prior permission of President for its introduction in the Parliament. While Financial Bills-II under Article 117 (3) do not require prior permission of President for its introduction in the Parliament. however, the only special feature of this bill is that it cannot be passed by either House of Parliament unless the President has recommended to that House the consideration of the bill.

Option 4 is correct A bill to form the new state, to increase or diminish the area of state, to alter the boundaries of state, or to change the name of the state require prior permission of President for its introduction in the Parliament.

Option 5 is correct. A bill imposing any surcharge on a tax for the purpose of centre also require prior permission of President for its introduction in the Parliament.

#87. Consider the following statements with reference to quasi-federal structure of Indian Constitution:

1. The State list in the Seventh Schedule contains more subjects than the Union list.

2. The Parliament has authority to make laws on the residual subjects.

Which of the above given statements is/are true?

The Indian Constitution possesses several unitary or non-federal features, having a strong centre is clearly one of it. The Seventh Schedule to the Constitution of India defi nes and specifies allocation of powers and functions between Union & States. It contains three lists; i.e., Union List, State List and a Concurrent List.

Statement 1 is incorrect: Originally there was 97 subjects in union list but now it is 100 subjects in union list. And in state list there was 66 subjects but now it is 61 subjects. And in concurrent list there was 47 subjects but now it is 52 subjects in concurrent list Thus the Union list has more subjects not the state list. And over the period, the union list has grown and state list has shrunk, highlighting growing centralizing tendency.

Statement 2 is correct: Article 248 of the constitution clearly states that the Union Parliament has exclusive power to make any law with respect to any matter not enumerated in the Concurrent List or the State List.

#88. Consider the following statements with reference to the resolution passed by the Rajya Sabha to make laws with respect to matter enumerated within the State List

1. Such a resolution lasts for six months at a time

2. A law so enacted per above method, applies only to those states which have passed the resolutions.

3. A law so enacted can be amended or repealed only by the President.

Which of the above given statements is/are correct?

Under Article 249, if the Rajya Sabha passes a resolution supported by 2/3rd of the members present and voting, Parliament should make laws with respect to any matter enumerated within the State List, then the Parliament becomes competent to make laws on that matter

Statement 1 is incorrect: Such a resolution normally lasts for one year at a time. It may be renewed any number of times, but not exceeding one year at a time.

Statement 2 is correct: A law so enacted after the states’ resolution applies to only to those states which have passed the resolutions. However, any other state may adopt it afterwards by passing a resolution to that effect in its legislature. The effect of passing a resolution under the above provision is that the Parliament becomes entitled to legislate with respect to a matter for which it has no power to make a law. On the other hand, the respective state legislature ceases to have the power to make a law with respect to that matter.

Statement 3 is incorrect: The law made by the parliament after the states’ resolution can be amended or repealed only by the Parliament (not President) and not by the legislatures of the concerned states.

#89. The Indian Constitution contains the “Full Faith and Credit” clause, which is related to:

1. Any official record made by a public servant in the discharge of his offi cial duties

2. Public records of each state

3. Executive acts of the government of a state

Which of the above options is/are correct?

Under the Constitution, the jurisdiction of each state is confined to its own territory. Hence, it is possible that the acts and records of one state may not be recognised in another state. Every state must recognize and respect the judgments, judicial proceedings, laws & records of other states. To remove any such difficulty, Constitution lays down the following: Full faith and credit is to be given throughout the territory of India to public acts, records and judicial proceedings of the Centre and every state. Hence,

Option 2 is correct. This clause is primarily invoked to enforce the functioning of an union, a state refusing to recognize acts and records of another state may give rise to confusion and inconvenience. This avoids inter-governmental conflicts.

Option 1 is correct. The expression ‘public record’ includes any offi cial book, register or record made by a public servant in the discharge of his offi cial duties.

Option 3 is correct. The expression ‘public acts’ includes both legislative and executive acts of the government.

#90. Consider the following statements:

1. Final judgements of civil courts in any part of India are capable of execution anywhere within India.

2. The courts of a state are always required to enforce the penal laws of another state.

Which of the above statements is/are correct?

Articles 260 and 261 of the Constitution of India specify the Union’s jurisdiction over territories outside India, as well as public acts, records, and judicial proceedings. Under the Constitution, the jurisdiction of each state is confi ned to its own territory. Hence, it is possible that the acts and records of one state may not be recognised in another state. To remove any such difficulty, the Constitution contains the “Full Faith and Credit” clause.

Statement 1 is correct. According to Article 261 (3), final judgments or orders delivered or passed by civil courts in any part of the territory of India shall be capable of execution anywhere within India (without the necessity of a fresh suit upon the judgement). The rule applies only to civil judgements and not to criminal judgements. Hence, A State can deny full faith and credit to a law, a public record, or the outcome of a court case in another State if it is a criminal matter.

Statement 2 is incorrect. Final judgements and orders of civil courts in any part of India are capable of execution anywhere within India. In other words, it does not require the courts of a state to enforce the penal laws of another state.

#91. Consider the following statements:

1. For the Parliament to make laws with respect to any matter enumerated in the State List, a resolution must be passed in both the Houses of the Parliament.

2. A resolution passed as stated above can be extended beyond one year.

Which of the statements given above is / are correct?

#92. Consider the following statements:

The Article 73 of the Constitution of India which deals with the extent of executive power of the Union, provides that:

1. The executive power of the Union extends to all matters with respect to which the Parliament has the power to make laws.

2. The Government of India may also exercise such authority available under any treaty

Which of the statements given above is/are correct?

#93. Consider the following statements about Union-State relations:

1. In case of overlapping of a matter between the three kinds of subjects of legislations, predominance has been given to the Union Legislation.

2. In the concurrent sphere, in the case of repugnancy between a Union and a State law relating to the same subject, the former prevails, even if the State law was reserved for the assent of the President and has received such assent.

3. The vesting of residual power under the Indian Constitution follows the precedent of Canada and not that of the Government of India Act, 1935.

Which of the statements given above is/are correct?

#94. Consider the following statements:

1. With the consent of the Government of India, the Governor of a State may entrust on the Union Government or to its offcers functions relating to a State subject , to which executive power of that State extends.

2. The President of India cannot entrust to any State Government or to its offcers, functions in relation to any matter to which the executive power of the Union extends.

3. There is a provision in the Constitution of India to create the National Integration Council.

Which of the statements given above is/are correct?

#95. What is the implication of the Union Government giving ‘Special Status’ to a State?

#96. Who, among the following, can establish additional courts for better administration of any existing law with respect to a matter contained in the Union List?

#97. Assertion (A):The All-India Services violate the federal principle of the Constitution as well as the autonomy of States.

Reason (R): The All-India Service offcers are governed by Central Government rules and the State Governments do not have full control over them.

Codes:

#98. Consider the following statements:

1. Parliament shall, while a proclamation of Emergency is in operation, have the power to make laws for the whole or any part of territory of India with respect to any of the matters enumerated in the State List.

2. Parliament has exclusive power to make any law with respect to any matter not enumerated in the Concurrent List or State List.

3. Parliament has power to make any law for the whole or any part of the territory of India for implementing any treaty, agreement or convention with any other country.

4. Parliament has power to legislate with respect to a matter in the State List in the national interest subject to the resolution passed by the Council of States by two-thirds majority.

Which of these statements are correct?

#99. A law made by Parliament having extra-territorial operation shall:

#100. Which of the following is not a principal source of non-tax revenue of the Union?

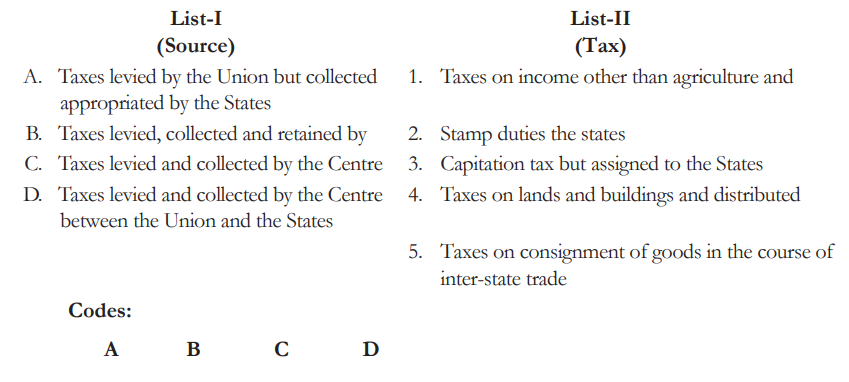

#101. Match List I with List II and select the correct answer using the codes given below:

#102. If any directions are issued by the Union Government to a State and they have not been complied with, then which one of the following statements is correct?

#103. Which one of the following is the correct statement?

A resolution passed by the Council of States under Article 249 empowering Parliament to legislate on State subjects in national interest remains in force for a period:

#104. Which of the following statements regarding the residuary powers in the Constitution of India are correct?

1. Residuary powers have been given to the Union Parliament

2. In the matter of residuary powers, the Constitution of India follows the Constitution of Australia

3. The fnal authority to decide whether a particular matter falls under the residuary power or not is the Parliament

4. The Government of India Act, 1935 placed residuary powers in the hands of the GovernorGeneral

Select the correct answer using the codes given below:

#105. Assertion (A):The Constitution makes a distinction between the legislative power to levy a tax and the power to appropriate the proceeds of tax so levied.

Reason (R): The constitution provides for grants-in-aid to the states from the central resources.

Codes:

#106. Which of the following is/are correctly matched?

1. Duty levied by the Union but collected and : Succession duty and estate duty in respect of appropriated by the States property other than agricultural land

2. Taxes levied and collected by the Union but : Stamp duties and duties of excise on assigned to the States medicinal and toilet preparations

Choose the correct answer from the codes given below:

#107. Which of the following constitutional provisions facilitate Union control over States?

1. All-India services

2. Grants-in-aid

3. Inter-State Councils

Select the correct answer using the codes given below:

#108. The idea of the Union giving directions to the States was adopted by the makers of the Indian Constitution from:

#109. Which one of the following statements is not correct?

#110. Assertion (A): Sarkaria Commission recommended that the Governor of a state should be appointed after consultation with the Chief Minister of the state.

Reason (R): This could be achieved through amending Article 165 of the Indian Constitution.

Codes:

#111. Who among the following said, “There can be no doubt that the standard of administration depends upon the caliber of civil servants who are appointed to these strategic posts”?

#112. On the subject of Income Tax:

#113. Verdicts of the Supreme Court of India in which of the following cases have a direct bearing on Centre-State relations?

1. S.R. Bommai Case

2. Kesavananda Bharati Case

3. Menaka Case

4. Indra Sawhney Case

Select the correct answer using the codes given below:

#114. Which one of the following is the correct statement?

The rule of repugnancy has application in a case where:

#115. Assertion (A):Parliament or a State Legislature should keep within the domain assigned to it and one should not trespass into the domain reserved for the other.

Reason (R): Legislation will be invalid if it encroaches on matters which have been assigned to another legislature.

Codes:

#116. Which of the following taxes are levied and collected and retained by the States?

1. Taxes on mineral rights

2. Taxes on entry of goods into a local area

3. Taxes on agricultural income

4. Taxes on professions, trades, callings and employments

Select the correct answer using the codes given below:

#117. Which of the following taxes belong to the Union exclusively?

#118. Consider the following statements:

The executive power of the Union extends to giving of directions to a State in respect of:

1. Construction and maintenance of means of communication of national or military importance

2. Maintenance of law and order in the State

3. Protection of railways within the State

4. Protection of secular character of the country

Which of the statements given above are correct?

#119. In case of inconsistency between laws made by Parliament and the laws made by the State Legislatures, which one of the following shall prevail?

#120. Consider the following pairs:

1. Taxes levied by the Union but collected : Stamp duties and appropriated by the

States 2. Taxes levied and collected by the Centre : Taxes on the sale of goods in the course but assigned to the States of inter-state trade

Which of the pairs given above is/are correctly matched?

#121. Which of the following formed a part of the terms of reference of the Punchhi Commission on Centre-State Relations constituted by the Government of India?

1. Panchayati Raj institutions

2. Communal violence

3. An integrated domestic market

4. Central Law Enforcement Agency

Select the correct answer using the codes given below:

#122. Consider the following statements:

The Parliament becomes competent to make law on a matter enumerated in the state list only if the:

1. Council of States passes a resolution supported by not less than two-thirds majority of the members present and voting that it is in the national interest that the Parliament should make law on such matter.

2. Council of States and House of the People, both passes a resolution that it is in the national interest that the Parliament should make law on such matter. 3. President gives the prior permission for such legislation.

4. Speaker of the House of the People in consultation with Chairman of the Council of States gives the prior permission for such legislation.

Which of these statements is/are correct?

#123. Assertion (A):There has been a growing demand for review of Centre-State relationships.

Reason (R): The states have no adequate resources to take up developmental projects.

Codes:

#124. Which one of the following statements is not correct?

#125. Which one of the following is not correct?

#126. The division of legislative powers between the Centre and the States under the present Constitution of India is similar to between the Centre and the Provinces under the Government of India Act, 1935, in some of the following respects:

1. In case of overlap of a matter as between the three lists or subjects, predominance in both is given to the Central legislature.

2. In case of repugnancy in the Concurrent feld, in both a Central law prevails over a Provincial or State law.

3. In both, residuary powers were vested in the Central legislature.

Which of the above are true?

#127. Match List I with List II and select the correct answer using the codes given below:

#128. Assertion (A):The second Commission on Centre-State relations was constituted by the Government of India by amending the Constitution of India, and thus a constitutional status was bestowed on it.

Reason (R): Issues like role of Governors, economic and social planning which were a part of the terms of reference of the Commission are very important issues in the governance of India.

Codes:

#129. Consider the following statements:

1. In extraordinary circumstances, the normal distribution of power between the Centre and the States is either suspended or the powers of the union parliament are extended over the state subjects.

2. The Indian Constitution vests the residuary power in the Union Parliament and the fnal decision as to whether a particular matter falls under the residuary power or not is that of the Supreme Court.

3. The Union Government has the power to give directions to the state governments to ensure due compliance with Union laws.

4. If the Legislatures of two or more states so resolve, Parliament can make laws with respect to any matter included in the state list relating to those states.

Which of these describe the nature of Indian Federalism?

#130. Consider the following statements:

1. Sarkaria Commission recommended that the Union Government may persuade the State Governments for constitution of an All-India Service for education.

2. All-India Services are included in the Concurrent List of the Constitution of India.

Which of the statements given above is/are correct?