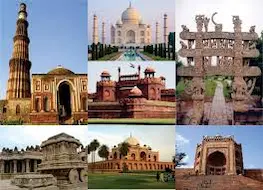

1.Monument Conservation in India – Policy

Why in News?

The Government of India has announced a major change in heritage conservation policy, enabling private entities to partner with the Archaeological Survey of India (ASI) for monument conservation through the National Culture Fund (NCF). This marks a significant shift from ASI’s earlier exclusive responsibility over conservation.

Key Takeaways

India has 3,700+ protected monuments, previously managed solely by ASI.

The new policy introduces private sector participation to strengthen capacity, funding, and efficiency.

Private players can now finance and manage conservation projects, under ASI’s supervision.

Additional Details

1. Public–Private Partnership (PPP) in Conservation

Corporates and donors can support projects through the National Culture Fund (NCF).

Incentives: 100% tax exemptions for contributions.

2. Role of Conservation Architects

The Ministry of Culture will prepare a panel of qualified conservation architects.

Donors can choose their architect, ensuring professional restoration aligned with heritage standards.

3. Checks and Balances

ASI retains supervisory authority.

Detailed Project Reports (DPRs) must follow the National Policy for Conservation (2014).

Ensures scientific methods and heritage sensitivity in conservation.

4. Pilot Phase

250 monuments selected for private participation in the first phase.

Includes a mix of major historical sites and lesser-known monuments requiring urgent restoration.

Significance of the Policy

Benefits

Enhanced Resources: ASI often faces fund and manpower shortages; private funding eases pressure.

Faster Conservation: More efficient project execution.

Public Engagement: Increases corporate and civil society involvement in heritage preservation.

Tourism Boost: Better-maintained monuments attract visitors, strengthening cultural tourism.

Concerns

Commercialization Risk: Fear of turning monuments into branding opportunities for corporates.

Unequal Focus: Big-ticket monuments may attract more donors, while smaller heritage sites remain neglected.

Accountability: Need for strict monitoring to prevent inappropriate interventions.

Legal and Policy Framework

Archaeological Survey of India (ASI) – Nodal body under the Ministry of Culture.

Ancient Monuments and Archaeological Sites and Remains (AMASR) Act, 1958 – Governs protection of monuments.

National Policy for Conservation (2014) – Ensures heritage-sensitive conservation practices.

National Culture Fund (NCF) – Established in 1996, serves as a vehicle for mobilizing extra-budgetary resources.

Exam Connect – Possible Questions

Prelims

1. The National Culture Fund (NCF), recently in news, is related to:

A. Funding for rural cultural festivals

B. Mobilizing resources for heritage conservation

C. Promoting cultural exports

D. Subsidizing classical art education

Answer:B. Mobilizing resources for heritage conservation

2. Consider the following statements about the new monument conservation policy in India:

1.Private players can finance and manage conservation projects under ASI supervision.

2.Donors receive 100% tax exemption for contributions made through the NCF.

3.Detailed Project Reports must align with the National Policy for Conservation (2014).

Which of the above are correct?

A. 1 and 2 only

B. 2 and 3 only

C. 1 and 3 only

D. 1, 2, and 3

Answer:D. 1, 2, and 3

Mains

1. Critically evaluate the recent policy shift allowing private participation in monument conservation in India. Discuss its potential benefits and challenges.

2. Monument conservation in India has long suffered from funding and capacity constraints. How can PPP models ensure both efficiency and cultural sensitivity in heritage management?

2. Empowering Women in Agriculture – Governance

Why in News?

The Periodic Labour Force Survey (PLFS) 2023–24 shows that women’s participation in agriculture has risen sharply. However, nearly half of them remain unpaid, exposing deep-rooted gender disparities in rural farm employment.

Status of Women in Agriculture in India

Feminisation of Agriculture

Women make up 42% of India’s agricultural workforce, a 135% increase in the past decade.

2 out of 3 rural women work in agriculture.

Prevalence of Unpaid Work

Nearly 50% of women in agriculture are unpaid family workers.

Unpaid women workers rose from 23.6 million (2017-18) to 59.1 million (2024-25 projected).

Regional Concentration

In Bihar and Uttar Pradesh, 80%+ women workers are in agriculture.

Half of them remain unpaid, reflecting rural distress.

Government Support Programs

Mahila Kisan Sashaktikaran Pariyojana (MKSP): Training & capacity building.

Kisan Credit Cards: Formal credit access.

Self-Help Groups (SHGs): Collective bargaining, microfinance, sustainable farming.

Factors Driving Feminisation of Agriculture

Male Out-Migration → Men migrate for urban jobs (construction, services, govt. work), leaving women to manage farms.

Growth of Contract Farming → Labour-intensive crops (tea, floriculture, horticulture) prefer women for reliability and low wages.

Patriarchal Norms → Women’s agricultural work seen as an extension of domestic chores, not as primary employment.

Limited Alternatives → Barriers of literacy, mobility, and social norms restrict access to non-farm jobs.

Systemic Barriers: Mnemonic – WOMEN

W – Wage Discrimination: Women earn 20–30% less than men in agriculture.

O – Omission from Decision-Making: Male dominance in extension services, Panchayats, cooperatives → women excluded.

M – Machinery and Tool Mismatch: Farm tools designed for male physique; women lack access to technology/finance.

E – Entrenched Domestic Double Burden: Household + farm work creates time poverty, limiting training/market access.

N – Negation of Land & Identity Rights: Women own only 13–14% of land → without land titles, they are treated as “helpers,” not farmers.

Measures to Empower Women Farmers: Mnemonic – GROW

G – Guarantee Market Access

Use FTAs (like India–UK) to promote exports from women-intensive sectors: tea, spices, dairy.

Support organic, GI-tagged goods where women’s traditional knowledge is vital.

R – Resource Rights & Reforms

Encourage joint or individual land ownership for women.

Scale up women-led FPOs and SHGs for credit, insurance, economies of scale.

O – Open Digital Gateways

Expand e-NAM, promote voice-first AI tools (BHASHINI, Jugalbandi, Digital Sakhi).

Build digital & financial literacy for women farmers.

W – Well-being & Social Support

Provide creches near farms, safe water, clean energy → reduce domestic burden.

Media campaigns & awards to create role models of women farmers.

Way Forward

Recognize women as farmers, not helpers, in all policies.

Shift from welfare-based support to empowerment through rights and resources.

Integrate gender-sensitive planning in agriculture, rural infrastructure, and skilling.

Exam Connect – Possible Questions

Prelims

1. Which of the following factors have contributed to the feminisation of agriculture in India?

1.Male out-migration to cities

2.Growth of contract farming in labour-intensive crops

3.Patriarchal norms assigning women to domestic and farm work

4.Enhanced access of women to industrial employment

A. 1, 2 and 3 only

B. 1 and 4 only

C. 2, 3 and 4 only

D. 1, 2, 3 and 4

Answer:A. 1, 2 and 3 only

Explanation: Feminisation is driven by migration, contract farming, and social norms—not by women’s access to industrial jobs.

2. The Mahila Kisan Sashaktikaran Pariyojana (MKSP) is implemented under which umbrella programme?

A. National Food Security Mission

B. Deendayal Antyodaya Yojana – NRLM

C. Rashtriya Krishi Vikas Yojana

D. National Rural Health Mission

Answer:B. Deendayal Antyodaya Yojana – NRLM

Mains

1.“The feminisation of Indian agriculture is a paradox of visibility without empowerment.” Critically examine.

2.Discuss the systemic barriers that prevent women from being recognized as farmers in India. Suggest measures to ensure their empowerment and economic independence.

3. Preventive Detention and the National Security Act, 1980 – Polity

Why in News?

Climate activist Sonam Wangchuk was arrested under the National Security Act (NSA), 1980.

The law empowers authorities to detain individuals to prevent potential threats to public order and national security.

Wangchuk had been leading protests for statehood for Ladakh and inclusion under the Sixth Schedule.

What is Preventive Detention?

Definition

Preventive detention = detaining an individual not for an offence already committed, but to prevent possible future actions that may disturb public order, national security, or essential supplies.

It is anticipatory, unlike punitive detention which follows conviction for an offence.

Constitutional Provisions (Article 22)

Permits Preventive Detention by law.

Maximum detention without Advisory Board approval: 3 months.

Advisory Board: Consists of judges qualified to be High Court judges; reviews cases for extended detention.

Parliament’s Role:

Can prescribe detention beyond 3 months.

Can set maximum limits and procedures.

Rights of the Detained:

Must be informed of reasons for detention.

May make a representation against detention.

However, facts may be withheld if disclosure threatens public safety.

Significance

Linked to Article 355, which obligates the Union to protect states against external aggression and internal disturbance.

Used as a tool to prevent potential law & order breakdowns.

Major Preventive Detention Laws in India

National Security Act (NSA), 1980 – covers defense, security, public order, essential supplies.

Unlawful Activities (Prevention) Act (UAPA), 1967 – deals with terrorism & unlawful associations.

Conservation of Foreign Exchange & Prevention of Smuggling Activities Act (COFEPOSA), 1974 – aimed at smuggling and forex violations.

State-specific Public Safety Acts (e.g., J&K Public Safety Act).

Judicial Stand on Preventive Detention

Ameena Begum vs State of Telangana (2023) → Preventive detention = exceptional measure, not routine.

Rekha vs State of Tamil Nadu (2011) → Preventive detention is an exception to Article 21 and must be used sparingly.

Anukul Chandra Pradhan vs Union of India (1997) → Purpose is protection of state security, not punishment.

The National Security Act (NSA), 1980

Background

Preventive detention roots: Colonial rule (wartime controls).

Post-Independence:

Preventive Detention Act, 1950 → expired in 1969.

MISA, 1971 (widely misused during Emergency) → repealed in 1978.

NSA enacted in 1980, consolidating preventive detention powers.

Key Features

Authorities empowered:

Central & state governments.

District Magistrates & Police Commissioners.

Grounds for detention:

Acts prejudicial to defense, foreign relations, national security, public order, or essential supplies.

Detention procedure:

Grounds must be communicated within 5–15 days.

Representation allowed, reviewed by an Advisory Board within 3 weeks.

Maximum detention: 12 months, unless revoked earlier.

Limitations and Concerns

No right to legal representation before Advisory Board.

Govt. can withhold information in “public interest”.

Broad and discretionary powers → risks of misuse against political dissent, activists, and minorities.

Criticism: “A colonial-era mindset” incompatible with democratic rights and liberty.

Exam Connect – Possible Questions

Prelims

1. Which of the following statements about Preventive Detention under the Indian Constitution are correct?

1.A person can be detained up to 6 months without reference to an Advisory Board.

2.Preventive detention is explicitly provided under Article 22.

3.Parliament alone can extend preventive detention beyond 3 months.

A. 1 and 2 only

B. 2 and 3 only

C. 1 and 3 only

D. 1, 2 and 3

Answer:B. 2 and 3 only

Explanation: Max. detention without Advisory Board = 3 months (not 6). Article 22 allows it. Parliament sets extensions.

2. The National Security Act, 1980 empowers which of the following authorities to issue preventive detention orders?

1.Central Government

2.State Governments

3.District Magistrates

4.Police Commissioners

A. 1 and 2 only

B. 1, 2 and 3 only

C. 1, 2, 3 and 4

D. 2 and 4 only

Answer:C. 1, 2, 3 and 4

Mains

1. Preventive detention is a constitutional paradox in India—permitted by Article 22 but in tension with Article 21. Critically discuss in the context of the National Security Act, 1980.

2. The Supreme Court has repeatedly cautioned against the routine use of preventive detention laws. Evaluate the challenges and suggest reforms to balance state security with individual liberty.

4. Centenary of Union Public Service Commission (UPSC) – Polity

Why in News?

On October 1, 2025, the Union Public Service Commission (UPSC) celebrated its 100th anniversary since its establishment in 1926.

Over the past century, the UPSC has stood as a pillar of meritocracy, shaping India’s civil services and contributing to governance reforms.

Historical Background

1919 Montagu-Chelmsford Reforms (Government of India Act, 1919):

Proposed the idea of a permanent, impartial body to regulate recruitment and service conditions.

Lee Commission (1924):

Recommended creation of a Public Service Commission.

1 October 1926:

Public Service Commission established with Sir Ross Barker as its first Chairman.

Government of India Act, 1935:

Renamed it as Federal Public Service Commission (FPSC).

1950 (Post-Constitution):

FPSC became the Union Public Service Commission (UPSC) under Article 378 of the Constitution.

Constitutional Provisions

Articles 315–323 (Part XIV, Chapter II): Establishment and functioning of UPSC.

Article 315: Provides for UPSC at the Union and State levels.

Article 320: Functions of the UPSC.

Article 323: Power of Parliament to regulate UPSC functioning.

Independence Safeguards: Chairman and members enjoy fixed tenure, removal process only by President (and in some cases after SC inquiry).

Role and Functions of UPSC

Recruitment to All India Services (IAS, IPS, IFS) and Central Services (Group A & B).

Conducts prestigious exams: Civil Services Exam, Engineering Services, NDA, CDS, Medical Services, CAPF, etc.

Advises the Government on:

Recruitment methods.

Promotions and disciplinary actions.

Service conditions.

Ensures a fair, impartial, and merit-based selection system.

Reforms by UPSC – PRATIBHA Setu Initiative

A new centralized digital platform launched by UPSC.

Stores verified biodata of candidates who:

Qualified for UPSC interviews but were not selected.

Employers (Govt. & private sector) can access these profiles.

Objective:

Provide alternative career opportunities.

Utilize the talent pool of UPSC aspirants who have demonstrated high merit.

Significance of UPSC at 100 Years

Meritocracy & Neutrality: UPSC has remained independent and upheld integrity in recruitment.

Nation-building Role: Created a professional, apolitical, pan-Indian bureaucracy.

Social Inclusion: Through reservation policies, ensured representation of marginalized groups.

Administrative Reforms: Adapted exams and syllabi to match evolving governance needs.

Challenges Ahead

Rising unemployment & aspirant burden – Millions apply each year, few get selected.

Syllabus overload & coaching dependence – Questions over accessibility and equity.

Need for lateral entry – To balance domain expertise with generalist bureaucracy.

Technology adaptation – Integrating AI, digital exams, transparency in evaluation.

Exam Connect – Possible Questions

Prelims

1. The Union Public Service Commission (UPSC) was first established in India following the recommendations of:

A. Hunter Commission

B. Lee Commission

C. Simon Commission

D. Islington Commission

Answer:B. Lee Commission

2. Consider the following statements about UPSC:

1.It is established under Article 315 of the Constitution.

2.Its members can be removed by the President only after a Supreme Court inquiry.

3.UPSC’s jurisdiction extends to both Union and State services.

Which of the above are correct?

A. 1 and 2 only

B. 1 and 3 only

C. 2 and 3 only

D. 1, 2 and 3

Answer:A. 1 and 2 only

(Explanation: Statement 3 applies to both UPSC and State PSCs separately, not that UPSC covers State services directly.)

Mains

1. Discuss the role of UPSC in strengthening India’s civil services. How does it balance meritocracy with the need for social justice?

2. In the light of UPSC’s centenary, critically examine the reforms needed to make India’s recruitment system more inclusive, transparent, and future-ready.

5. RBI Holds Rates, Focuses on Growth with Regulatory Easing – Economy

Why in News?

On October 1, 2025, the Reserve Bank of India (RBI) in its Monetary Policy Committee (MPC) meeting kept the repo rate unchanged at 5.5%.

This comes after a 100 basis points cut earlier in 2025.

With inflation projected at 2.6% (well below 4% target), the RBI has space for further easing but has chosen caution.

Instead, the RBI has introduced 22 structural/regulatory reforms to stimulate growth and deepen financial stability, signaling a shift beyond mere interest rate tools.

Key Takeaways

Monetary Policy Decision

Repo rate maintained at 5.5%.

Neutral stance → indicates flexibility for future changes depending on inflation and growth data.

Growth Outlook

GDP growth forecast revised upward to 6.8% in FY 2025–26.

Driven by strong consumption demand, rising investment, and services sector buoyancy.

Inflation Projections

CPI inflation revised down from 3.1% → 2.6%.

Factors:

Decline in food prices.

GST rationalisation lowering indirect tax burden.

Global Economic Context

Current Account Deficit (CAD) narrowed to 0.2% of GDP (Q1 FY 2025–26).

Boosted by:

Strong services exports

High remittance inflows.

Regulatory Easing and Reforms (22 Measures)

Focus on structural growth drivers beyond monetary rates.

Likely areas:

Deepening corporate bond market.

Enhancing digital lending and fintech regulation.

Expanding rupee settlement for cross-border trade.

Improving credit flows to MSMEs and startups.

Promoting sustainable/green finance.

Implications

Positive Outcomes

Supports growth while keeping inflation in check.

Encourages long-term resilience instead of short-term stimulus.

Regulatory easing could unlock credit, boost investments, and expand financial inclusion.

International investors reassured of India’s macro-stability.

Risks/Challenges

Very low inflation (2.6%) may risk deflationary pressures if demand weakens.

Global uncertainties (oil prices, US Fed policies, geopolitical tensions) could disrupt stability.

Implementation of regulatory reforms must be efficient to avoid systemic risks.

Exam Connect – Possible Questions

Prelims

1. In the context of India’s monetary policy, “repo rate” refers to:

A. The rate at which the RBI lends to commercial banks against government securities.

B. The rate at which commercial banks lend to the RBI.

C. The interest rate on savings deposits.

D. The discount rate charged on treasury bills.

Answer:A. The rate at which the RBI lends to commercial banks against government securities.

2. The narrowing of India’s Current Account Deficit (CAD) in 2025–26 was mainly due to:

1.Strong services exports

2.GST rationalisation

3.High remittances

4.Decline in gold imports

A. 1 and 3 only

B. 2 and 4 only

C. 1, 2 and 3 only

D. 1, 3 and 4 only

Answer:A. 1 and 3 only

Mains

1. RBI’s recent decision to hold rates and instead focus on regulatory reforms reflects a new approach to monetary policy. Discuss the significance of this shift for India’s long-term economic stability.

2. With inflation falling below the RBI’s 4% target, what challenges and opportunities does this present for monetary and fiscal policy in India?

6. RBI’s Reforms – Towards Internationalising the Rupee and Deepening Financial Markets – Economy

Why in News?

Against the backdrop of India–US trade tensions and a global search for alternatives to the US dollar, the Reserve Bank of India (RBI) has introduced major financial reforms.

The measures aim to:

Strengthen financial markets

Enhance corporate financing options

Advance rupee internationalisation

Reduce overdependence on the dollar

Key Takeaways

Monetary Policy Decision

Repo rate maintained at 5.5% with a neutral stance → indicates policy stability to balance growth and inflation.

Corporate Takeover Financing

Banks can now finance corporate acquisitions and takeovers.

Earlier restrictions (2016) are removed → provides structured & cost-effective channels for M&A activity, boosting corporate competitiveness.

Internationalisation of the Rupee

Cross-border lending in rupees allowed for neighbouring countries.

Reduces reliance on the US dollar in regional trade.

Strengthens the rupee’s role in South Asia’s financial ecosystem.

Market Liquidity Enhancements

Increased lending limits for:

IPO financing

Loans against shares

Expected to boost equity market participation and improve bond market liquidity.

Expansion of Benchmarked Currencies

RBI allows diversification of benchmark currencies for trade and financial instruments.

Improves pricing efficiency and reduces risks of dollar dominance.

Relaxation of Borrowing Framework

Scrapping of 2016 restrictions on bank lending to large corporates.

Restores flexibility while managing risks through prudential norms.

Broader Significance

Internationalisation of the Rupee

Aims to establish the rupee as a settlement currency in trade & financial transactions.

Reduces vulnerability to exchange rate shocks and sanction risks tied to the dollar.

Supports India’s ambition to become part of a multipolar financial order.

Deepening Financial Markets

Stronger IPO and bond markets → better capital mobilisation.

Increased corporate financing avenues → boosts M&A activity and global competitiveness of Indian firms.

Greater liquidity → improved investor confidence.

Strategic Autonomy

Enhances financial sovereignty by limiting overdependence on external currencies.

Aligns with India’s broader goals under Atmanirbhar Bharat and Viksit Bharat 2047.

Challenges and Risks

Currency Volatility: Expanding rupee use globally may increase exposure to speculative pressures.

Banking Risks: Takeover financing and expanded corporate lending could raise NPAs if poorly regulated.

Regulatory Oversight: Requires strong prudential frameworks to avoid financial instability.

Global Acceptance: The rupee must gain wider trust abroad; limited convertibility remains a barrier.

Exam Connect – Possible Questions

Prelims

1. The recent RBI reforms aim to:

1.Allow banks to finance corporate takeovers

2.Promote cross-border lending in rupees|

3.Increase market liquidity through IPO financing

4.Restrict borrowing frameworks for corporates

Which of the above are correct?

A. 1, 2 and 3 only

B. 1, 2 and 4 only

C. 2, 3 and 4 only

D. 1, 2, 3 and 4

Answer: A

2. Internationalisation of the rupee primarily aims at:

A. Reducing India’s fiscal deficit

B. Decreasing India’s dependence on the US dollar

C. Controlling inflation through monetary policy

D. Boosting agricultural subsidies

Answer:B. Decreasing India’s dependence on the US dollar

Mains

1. Discuss the significance of rupee internationalisation for India’s financial sovereignty and economic growth. What challenges does it face in becoming a global currency?

2. The RBI’s recent reforms have sought to deepen Indian financial markets while reducing dollar dependence. Critically evaluate the potential benefits and risks of these measures.