1. Challenges Confronting the Election Commission of India – Polity

Why in News?

The Election Commission of India (ECI) is under scrutiny following the Bihar Special Intensive Revision (SIR) exercise, which led to the deletion of 65 lakh names from the electoral rolls. The Supreme Court has questioned the transparency and accountability of the ECI in maintaining voter lists.

Context and Background

- Bihar SIR 2025: Initiated in June 2025, it resulted in mass voter deletions.

- The Supreme Court has asked the ECI to publish booth-wise deleted voter lists and explain reasons for each deletion.

- This event has ignited a broader debate about electoral transparency, voter rights, and the autonomy of constitutional institutions.

Key Details

Constitutional Mandate of ECI:

- Article 324 of the Indian Constitution empowers the ECI to conduct elections to:

- Parliament

- State legislatures

- President and Vice President

- ECI is expected to function independently, fairly, and impartially.

Issues & Challenges:

- Electoral Roll Manipulation:

- Allegations in multiple states (e.g., Karnataka, Maharashtra).

- Concerns about transparency and absence of machine-readable voter rolls.

- Appointment Process Controversy:

- The Chief Election Commissioner and Other Election Commissioners Act, 2023 changed the selection process.

- New structure: 3-member panel (PM, Union Minister, Leader of Opposition).

- The 2:1 government majority raises fears of executive control over ECI.

- Voter Rights & Inclusion:

- Deletion of names without adequate notice threatens the right to vote.

- Internal migrants face disenfranchisement due to outdated systems.

- Judicial Oversight:

- Supreme Court’s intervention reflects growing concerns about lack of transparency and potential constitutional violations.

- Cybersecurity & Data Handling:

- The need for digital, secure, and transparent voter rolls remains unmet.

- Resistance to tech reforms undermines public trust.

- Political Fallout:

- Opposition parties have protested in Parliament, accusing the ECI of partisanship and lack of accountability.

Exam Connect – Possible Questions

Prelims

1. Under which Article of the Constitution is the Election Commission of India constituted?

A. Article 320

B. Article 324

C. Article 326

D. Article 328

Answer: B. Article 324

2. The Chief Election Commissioner and other Election Commissioners are now appointed by a panel consisting of:

A. President, Prime Minister, Chief Justice of India

B. Prime Minister, Home Minister, Leader of Opposition

C. Prime Minister, Union Cabinet Minister, Leader of Opposition in Lok Sabha

D. Chief Justice of India, Prime Minister, Leader of Opposition in Rajya Sabha

Answer: C. Prime Minister, Union Cabinet Minister, Leader of Opposition in Lok Sabha

Mains

1.“The Election Commission of India must remain free from executive interference to uphold the democratic fabric of the country.”

Critically examine in light of recent controversies surrounding the appointment and functioning of the ECI.

2.Discuss the challenges faced by the Election Commission of India in ensuring free and fair elections in India. Suggest reforms to strengthen the autonomy and transparency of the institution.

2. New Income Tax Bill 2025 Passed in Parliament – Economy

Why in News?

Parliament has passed the New Income Tax Bill, 2025, aiming to overhaul the Income Tax Act of 1961, which had become outdated due to excessive amendments and complexity. This reform seeks to simplify tax laws, improve taxpayer experience, and bring clarity and transparency to India’s direct tax framework.

Context and Background

- The Income Tax Act, 1961 had 47 chapters and 819 sections and was heavily amended over the decades.

- Reforms were long overdue to:

- Simplify compliance

- Reduce litigation

- Enhance transparency and digital adaptability

Key Features and Takeaways

1. Structural Simplification

- Chapters reduced from 47 to 23

- Sections reduced from 819 to 536

- Legal language simplified with practical examples to make tax laws more accessible to common citizens.

2. Updated Return Filing

- Taxpayers can now revise and update their returns for up to 4 years without incurring penalties — a move to promote voluntary compliance.

3. New “Tax Year” Concept

- Introduces a defined tax year (April 1 – March 31) to bring consistency and clarity in assessments.

4. Digital & Virtual Economy Provisions

- Broader definition of “virtual digital space”, enabling taxation of digital assets and transactions.

- Enhanced powers to tax authorities in search and seizure operations.

5. Privacy Concerns

- Taxpayers must now provide technical and digital access (e.g., passwords) during searches.

- Raises concerns over privacy rights and data protection in a digital financial system.

6. MAT and AMT Reorganized

- Minimum Alternate Tax (MAT) and Alternate Minimum Tax (AMT) have been clarified through structured sub-sections.

Exam Connect – Possible Questions

Prelims

1. Which of the following is a new feature introduced by the Income Tax Bill, 2025?

A. Abolition of Income Tax for individuals under 50 years

B. Separate provisions for MAT and AMT

C. Removal of TDS system

D. Introduction of wealth tax

Answer: B. Separate provisions for MAT and AMT

2. The term “tax year” as defined under the New Income Tax Bill, 2025, refers to:

A. January 1 – December 31

B. March 31 – April 1

C. April 1 – March 31

D. Financial year defined by RBI

Answer: C. April 1 – March 31

Mains

1.“The New Income Tax Bill, 2025 aims to enhance transparency, simplify compliance, and bring tax laws in line with the digital age.”Critically evaluate this statement in the context of taxpayer rights and privacy concerns.

2. Discuss the rationale and implications of replacing the Income Tax Act, 1961 with the new Income Tax Bill, 2025. In your answer, highlight both the simplification benefits and the emerging challenges in implementation.

3. Semiconductor Industry in India – Science and Technology

Why in News?

- The Union Cabinet has approved four new semiconductor projects under the India Semiconductor Mission (ISM) in Odisha, Punjab, and Andhra Pradesh.

- With this, India now hosts 10 semiconductor projects across 6 states, marking a major step in self-reliance in chip manufacturing.

Context and Background

Semiconductors form the backbone of all modern electronics — from smartphones to satellites. India’s over-dependence on imports, especially from China, and growing domestic demand have driven the urgent need to build indigenous capability through the India Semiconductor Mission (ISM) and related schemes.

Key Trends and Opportunities

Market Size & Demand

- Projected growth: From $52 billion (2024–25) to $103.4 billion by 2030.

- CAGR: 13%

- Major contributors: Mobile phones, IT hardware, automotive, industrial electronics.

- India is the 2nd-largest 5G smartphone market globally (after China).

Global Landscape

- Global leaders: Taiwan, South Korea, Japan, China, USA.

- India is highly import-dependent: Import of ICs, memory chips, amplifiers grew by 2,000% to 4,800% between FY16–FY24.

- China supplies nearly one-third of these imports.

India Semiconductor Mission (ISM)

Launched in 2021 | Under: Ministry of Electronics and IT (MeitY)

Objective: Strengthen India’s position in the global electronics value chain and reduce import dependence.

Focus Areas:

- Chip fabrication units (fabs)

- Testing & packaging facilities (ATMP/OSAT)

- Chip design and R&D

- Skilled workforce development

- Global investments and technology partnerships

Key Schemes Under ISM

| Scheme | Purpose | Support |

|---|---|---|

| Semiconductor Fabs Scheme | Fabrication plants | Up to 50% fiscal support |

| Display Fabs Scheme | AMOLED/LCD display units | Up to 50% support |

| ATMP/OSAT Scheme | Testing & packaging | 50% assistance for downstream infra |

| Design Linked Incentive (DLI) | Promote chip design startups & MSMEs | Up to ₹15 crore per company |

Additional Policy Support

- PLI Scheme: Incentives for large-scale electronics and IT hardware manufacturing.

- SPECS: Support for electronic components and semiconductors.

- EMC & EMC 2.0: Electronics manufacturing clusters.

- FDI policy: 100% FDI permitted under automatic route.

- Tax & Procurement: Rationalized tariffs, procurement preference for Made-in-India products.

Key Challenges

- Infrastructure & Tech Deficiency:

- Chip fabrication requires cleanrooms and 1,000+ complex steps.

- High capital cost and tech dependency on foreign firms like ASML (EUV lithography).

- Lack of domestic IP hinders innovation.

- Skilled Workforce Gap:

- Current workforce: ~2.2 lakh.

- Required: 4.7–5.7 lakh by 2027 (shortfall of 2.5–3.5 lakh).

- Global Competition:

- Taiwan and South Korea dominate chip foundries.

- Nvidia, ARM, TSMC lead chip design and production.

- Environmental & Regulatory Concerns:

- Heavy energy use, toxic waste, and stringent compliance increase costs.

- IP disputes, export controls, and red tape remain bottlenecks.

Recommended Steps Forward

- Skill Development: Establish semiconductor-focused training centres.

- Indigenous R&D and IP: Promote local design and innovation.

- Chip Diplomacy: Strengthen global partnerships (e.g., with USA, Japan).

- Niche Focus: Target segments like MEMS, sensors, and compound semiconductors.

- Private Sector Participation: Encourage projects like Tata-PSMC Fab in Gujarat.

Exam Connect – Possible Questions

Prelims

1. What is the main objective of the India Semiconductor Mission (ISM)?

A.Promote AI and blockchain applications

B. Increase smartphone exports

C. Make India self-reliant in semiconductor manufacturing

D. Develop clean energy technology

Answer: C. Make India self-reliant in semiconductor manufacturing

2. Which of the following schemes supports semiconductor design startups with financial aid up to ₹15 crore?

A. EMC 2.0

B. SPECS

C. Design Linked Incentive (DLI)

D. PLI for IT Hardware

Answer: C. Design Linked Incentive (DLI)

Mains

1.“India’s semiconductor ambitions are central to its technological sovereignty and economic security.”

Critically evaluate India’s semiconductor policy landscape in light of global competition and domestic challenges.

2.Despite policy initiatives like the India Semiconductor Mission, India remains heavily dependent on semiconductor imports. Discuss the major bottlenecks in India’s semiconductor ecosystem and suggest a roadmap to overcome them.

4. Cess and Its Role in Union Finance – Economy

Why in News?

The Comptroller and Auditor General (CAG) has reported a shortfall of ₹3.69 lakh crore in transferring cess collections to their designated funds. This has raised serious questions about the transparency, accountability, and purposeful utilization of such levies by the Union government.

What is a Cess?

Definition:

A cess is a specific-purpose tax levied in addition to existing taxes or duties, as per Article 270 of the Constitution.

Purpose:

- Levied only for a Union purpose, not for general revenue expenditure.

- Examples:

- Education Cess (for primary education)

- Swachh Bharat Cess (for sanitation)

- Health and Education Cess

- The law must clearly specify the purpose of the cess.

- Cesses cannot be diverted for unrelated expenses.

Role in Union Finance

- Cess revenue is credited to the Consolidated Fund of India (CFI).

- It is not part of the divisible pool of taxes; hence, not shared with states.

- Cesses enhance Union fiscal flexibility, allowing targeted expenditure.

- However, failure to transfer cess to specific funds (e.g., Education Cess to the Prarambhik Shiksha Kosh) violates the principle of earmarked taxation.

Surcharge: How is it Different?

Constitutional Provision: Article 271

- A surcharge is an additional tax on existing taxes, especially income tax.

- It is levied to raise funds for the Union government for general purposes.

Applicability:

- Often imposed on high-income individuals and corporates (e.g., income > ₹50 lakh/year).

- Progressive in nature – higher income leads to higher surcharge rates.

Cess vs. Surcharge: Key Differences

| Aspect | Cess | Surcharge |

|---|---|---|

| Constitutional Basis | Article 270 | Article 271 |

| Purpose | Specific (e.g., health, education) | General Union revenue |

| Usage Restriction | Must be used only for stated purpose | No restriction |

| Sharing with States | Not shared | Not shared |

| Accountability | Requires earmarked fund | No such requirement |

Concerns Raised by CAG

- CAG found that Rs 3.69 lakh crore collected as cess was not transferred to designated funds.

- Violates principles of fiscal federalism and transparency.

- Raises concerns over:

- Accountability in public finance

- Trust in earmarked taxation

- State-level resource deficits due to central withholding

Exam Connect – Possible Questions

Prelims

1. Under the Constitution of India, the proceeds of which of the following taxes are not shared with the states?

A. Corporation Tax

B. Income Tax

C. Surcharge on Income Tax

D. Customs Duties

Answer: C. Surcharge on Income Tax

2. Consider the following statements regarding Cess in India:

1. Cess is levied for a specific purpose and must be used only for that purpose.

2. The proceeds of cess are shared between the Centre and States.

Which of the above statements is/are correct?

A. Only 1

B. Only 2

C. Both 1 and 2

D.Neither 1 nor 2

Answer: A. Only 1

Mains

1.“The growing use of cess and surcharge in Union taxation undermines the principles of fiscal federalism.”

Critically analyze this statement in light of recent CAG findings and Finance Commission recommendations.

2.Discuss the constitutional and functional differences between cess and surcharge. Evaluate their role and implications for Union finances and Centre-State fiscal relations.

5. Health Hazards of Plastic Pollution – Environment

Why in News?

- Recent negotiations in Geneva involving 180 countries to finalize a binding international treaty on plastic pollution ended without consensus.

- Key point of contention: Whether to limit plastic production or focus solely on waste management.

- Recognition of health impacts of plastics has emerged as a core issue blocking agreement.

- UNEP has acknowledged the urgency, but no binding agreement has been reached.

Key Takeaways

- Deadlock persists between countries advocating for production-level restrictions and those focusing on waste management.

- Health hazards from plastic chemicals and microplastics are increasingly being cited as urgent but understudied risks.

- The lack of financial and technical support from developed nations to developing countries is stalling progress.

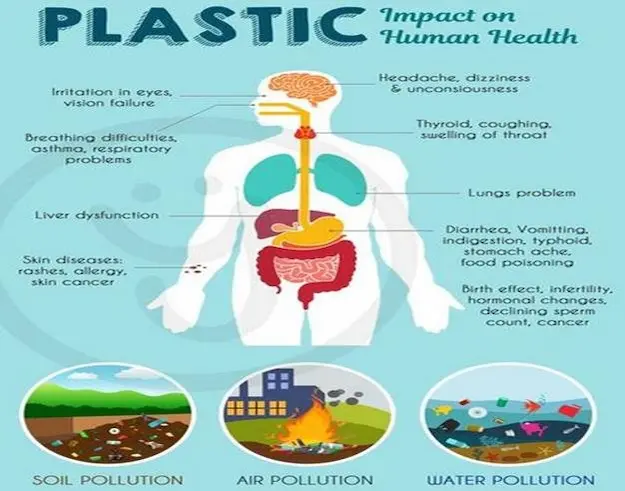

Health & Environmental Risks of Plastic

Chemical Composition:

- Plastics are composed of complex polymer mixtures and over 16,000 chemicals, many of which are:

- Endocrine-disrupting

- Carcinogenic

- Persistent and bioaccumulative

Human Health Risks:

- Research links exposure to certain plastic chemicals with:

- Thyroid dysfunction

- Hypertension

- Respiratory issues

- Certain cancers

- Microplastics have been found in:

- Human blood, placenta, breast milk, and lungs.

- Long-term health effects still being studied but raise serious concerns.

Environmental Impact:

- Plastics persist for centuries, polluting oceans, soils, and food chains.

- Affect marine biodiversity, contaminate freshwater systems, and enter agricultural soil.

India’s Approach to Plastic Pollution

- India primarily addresses plastic as a waste management issue.

- Initiatives include:

- Plastic Waste Management Rules, 2016 (amended in 2022)

- Single-use plastic bans (enforcement remains weak)

- Extended Producer Responsibility (EPR)

- Health risks of plastics are not formally acknowledged in policy or regulation.

Global Treaty Negotiation – Core Divisions

| Issue | Developed Nations | Developing Nations |

|---|---|---|

| Focus Area | Waste Management + Production Reduction | Mainly Waste Management |

| Financial Support | Reluctant to commit | Demand funding & tech transfer |

| Health Impacts | Urging recognition | Cautious due to economic dependence on plastics |

Exam Connect – Possible Questions

Prelims

1. Which of the following statements about microplastics is/are correct?

1. Microplastics are plastic particles smaller than five millimeters.

2. They have been found in human blood and breast milk.

3. They degrade within a few months in natural environments.

A. 1 and 2 only

B. 2 and 3 only

C. 1 and 3 only

D. 1, 2, and 3

Answer: A. 1 and 2 only

2. The United Nations Environment Programme (UNEP) is headquartered in:

A. Geneva

B. New York

C. Nairobi

D. Paris

Answer: C. Nairobi

Mains

1.“Plastic pollution is no longer just an environmental issue — it is increasingly a global public health concern.”

Critically examine the statement with reference to emerging scientific evidence and the status of global treaty negotiations.

2. Discuss India’s policy framework to manage plastic pollution. Should India formally recognize the health risks associated with plastic? Suggest a multi-dimensional strategy to address this growing challenge.

6. Wildfires – Environment

Why in News?

Recently, catastrophic wildfires in Albania, Greece, Italy, Portugal, Spain, and Turkey have claimed lives, displaced thousands, and reignited global concerns about climate-linked disasters. These fires are becoming more frequent, intense, and widespread, particularly in climate-vulnerable regions like Southern Europe, South Asia, and parts of the Himalayas.

What is a Wildfire?

A wildfire is an uncontrolled fire that spreads rapidly in natural areas such as forests, grasslands, scrublands, or tundra, fueled by heat, oxygen, and combustible material (fuel).

Types of Wildfires

| Type | Description |

|---|---|

| Surface Fire | Burns dry leaves, twigs, and grass on the forest floor. Most common type. |

| Underground / Zombie Fire | Burns below the surface in organic soil. Hard to detect and can persist for months. |

| Canopy / Crown Fire | Spreads through tree canopies. Highly intense and hard to control. |

| Controlled / Prescribed Burn | Planned and monitored fires used to reduce excess fuel and rejuvenate ecosystems. |

Causes of Wildfires

Natural Factors

- High temperatures, dry winds, and low humidity

- Mediterranean climate zones and dry monsoon cycles

- Climate change effects: heatwaves, El Niño, erratic rainfall

Human-Induced Factors

- Slash-and-burn agriculture

- Tourism and waste mismanagement

- Power lines, cigarette butts, campfires

- Deforestation and habitat fragmentation

Weak Management

- Outdated fire response systems

- Lack of early warning and predictive tech

- Poor enforcement of forest protection laws

Environmental & Human Impacts of Wildfires

| Impact Area | Description |

|---|---|

| Air Pollution | Emission of CO₂, PM2.5, methane → health risks & global warming |

| Biodiversity Loss | Loss of flora/fauna, habitat destruction (e.g., 17 million animals in Brazil, 2020) |

| Human Health | Respiratory illness, eye damage, mental trauma |

| Economic Damage | Property loss, crop destruction, high firefighting costs |

| Soil & Water Degradation | Soil erosion, water pollution from ash runoff |

Wildfires in India

- As per ISFR 2021:

- 36% of Indian forests are fire-prone

- 2.81% are extremely fire-prone, 7.85% are very highly fire-prone

- Sharp increases in wildfire incidents in Himalayan states:

- Jammu & Kashmir: ↑ 2822%

- Himachal Pradesh: ↑ 1339%

- Uttarakhand: ↑ 293%

Common Fuels:

- Pine needles, dry bamboo, monoculture plantations — highly flammable

Wildfire Management Tools

| Tool | Function |

|---|---|

| Pink Fire Retardant | A slurry of ammonium phosphate used to slow fire spread |

| Bambi Bucket | Aerial firefighting tool (helicopters) for water drops on inaccessible fires |

Solutions to Manage Wildfires

1. Integrated Fire Management

- Fuel load reduction via controlled burns

- Creation of firebreaks

- Fire safety regulations & community education

2. Community & Tribal Participation

- Engage Van Panchayats, tribals in early response

- Integrate traditional conservation knowledge

- Offer incentives and training

3. Technology & Early Warning

- Use AI and satellite monitoring

- Drone surveillance for real-time tracking

- Weather-based fire forecasting models

4. Ecosystem Restoration

- Plant fire-resistant native species

- Create green firebreaks

- Promote climate-resilient forestry & agroforestry

5. Policy & Eco-sensitive Development

- Declare no-go zones for mining and large infra projects in fire-prone areas

- Promote sustainable tourism, watershed protection

- Leverage blockchain for conservation fund tracking

Exam Connect – Possible Questions

Prelims

1. Which of the following statements regarding wildfires is/are correct?

1. Crown fires spread along the ground surface, consuming dry grass and twigs.

2. Zombie fires burn underground and may persist for months.

3. Bambi Buckets are used by helicopters to drop water over forest fires.

A.1 and 2 only

B. 2 and 3 only

C. 1 and 3 only

D. 1, 2, and 3

Answer: B. 2 and 3 only

2. As per the India State of Forest Report (ISFR) 2021, which of the following states showed a significant rise in forest fires?

A. Kerala, Tamil Nadu, Andhra Pradesh

B. Himachal Pradesh, Jammu & Kashmir, Uttarakhand

C. Bihar, Jharkhand, Odisha

D. Assam, Meghalaya, Tripura

Answer: B. Himachal Pradesh, Jammu & Kashmir, Uttarakhand

Mains

1.“The increasing frequency of wildfires is both a symptom and a driver of climate change.”

Discuss the causes and consequences of wildfires in India and suggest effective mitigation strategies.

2. Despite multiple policy frameworks, India’s wildfire response remains inadequate. Evaluate the limitations in India’s current forest fire management system and propose a multi-pronged approach to tackle the challenge.