1. Special Economic Zones (SEZs) – Economy

Why in News?

On June 9, 2025, the Government of India relaxed key regulations related to Special Economic Zones (SEZs) to promote domestic manufacturing of semiconductors and electronics components.

What are Special Economic Zones (SEZs)?

Definition:

Special Economic Zones (SEZs) are specially designated areas within a country that are subject to different economic laws than the rest of the country. These laws are often more liberal in nature to encourage industrial growth, trade, and investment.

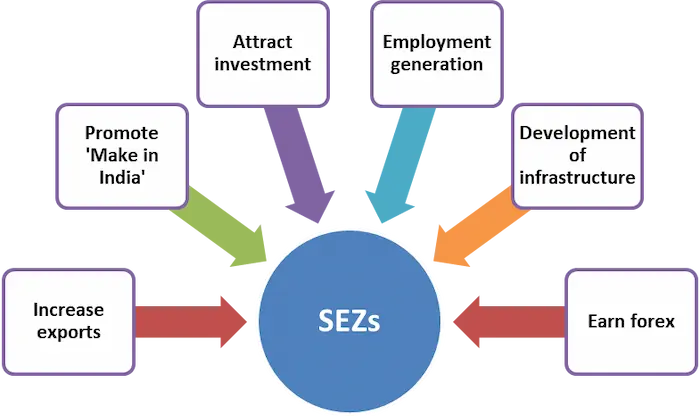

Objectives of SEZs:

- Boost exports of goods and services

- Generate employment opportunities

- Attract foreign and domestic investment

- Stimulate economic activity

- Improve infrastructure development

Types of Economic Zones (Global Classifications):

- Free Zones (FZs)

- Industrial Estates (IEs)

- Export Processing Zones (EPZs)

- Free Trade Zones (FTZs)

- Free Ports

SEZs in India – Overview:

- Asia’s first Export Processing Zone (EPZ) was established in Kandla, Gujarat in 1965

- SEZ Policy introduced in April 2000

- SEZ Act passed in May 2005, implemented from Feb 10, 2006

- As of March 31, 2024, India has 280 operational SEZs

Recent Amendments (June 2025):

To promote semiconductor and electronics production, the following changes have been made:

Reduced Land Requirement:

From 50 hectares to 10 hectares for semiconductor-focused SEZs

Domestic Sales Permitted:

SEZ units can now sell within the domestic market, subject to duties

Greater Autonomy to SEZ Authority:

The SEZ Board of Approval can waive certain land requirements to ease entry barriers

Significance of the Amendment:

- Encourages India’s semiconductor mission and Make in India push

- Enhances ease of doing business for electronics manufacturers

- Supports self-reliance (Atmanirbhar Bharat) in critical tech sectors

- Helps in job creation and reducing dependence on imports

Summary:

SEZs are crucial instruments of economic policy that attract investment, promote exports, and create jobs through favorable business environments. The recent policy shift lowering land requirements and permitting domestic sales for SEZ units reflects India’s focus on becoming a global hub for semiconductor and electronics manufacturing. This change is expected to unlock new industrial opportunities and strengthen infrastructure in a strategically important sector.

Exam Connect – Possible Questions

Prelims

1. Which of the following is correct about Special Economic Zones (SEZs)?

A. They follow the same economic regulations as the rest of the country

B. They were first introduced in India in 2005

C. They aim to boost exports and attract investment

D. Domestic sales from SEZs are completely duty-free

Answer: C. They aim to boost exports and attract investment

2. Which city hosted India’s first Export Processing Zone (EPZ)?

A. Mumbai

B. Chennai

C. Kandla

D. Surat

Answer: C. Kandla

3. As per the June 2025 amendments, the minimum land requirement for semiconductor SEZs has been reduced to:

A. 25 hectares

B. 10 hectares

C. 40 hectares

D. 5 hectares

Answer: B. 10 hectares

Mains

- What are Special Economic Zones (SEZs)? Discuss their role in promoting industrial growth in India.

- Evaluate the recent regulatory changes made to SEZs in June 2025 and their implications for India’s semiconductor manufacturing ecosystem.

- “SEZs are a vital component of India’s export-led growth strategy.” Critically examine in the context of recent policy amendments.

2. Capping of MGNREGS Spending and Its Implications – Governance

Why in News?

The Union Finance Ministry has, for the first time, imposed a spending cap (60%) for the first half of FY 2025–26 on the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS), a program that was previously demand-driven and exempt from such expenditure control mechanisms.

This decision subjects MGNREGS to the Monthly/Quarterly Expenditure Plan (MEP/QEP) introduced in 2017 to manage cash flows across schemes.

Understanding MGNREGS:

- Enacted Under: MGNREG Act, 2005

- Objective: Provide at least 100 days of wage employment in a financial year to every rural household whose adult members volunteer to do unskilled manual work.

- Nature: Statutory right-based scheme

- Focus Areas: Rural employment, poverty alleviation, asset creation, drought-proofing, and women’s empowerment

What is the Spending Cap and Why Was It Introduced?

- The government has capped MGNREGS spending to 60% of the annual allocation for the first six months of FY 2025–26.

- This is intended to prevent early budget exhaustion and allow better fiscal management.

- The scheme is now included under MEP/QEP, which regulates cash releases on a periodic basis.

Why is the Cap Problematic?

- Violates the Demand-Driven Nature of the Scheme:

MGNREGS responds to seasonal employment needs, especially in agricultural lean periods and drought-prone areas. Capping fund flow undermines this flexibility. - Legal and Constitutional Concerns:

- MGNREGS is a legal entitlement, not a discretionary scheme.

- Courts (e.g., Swaraj Abhiyan v. Union of India, 2016) have held that fiscal constraints cannot override legal entitlements.

- Operational Challenges for States:

- Once the cap is hit, wages may be delayed, and employment requests may be denied, violating the Act.

- No official guidelines on what happens when funds are exhausted early.

- Recurring Budget Overruns and Dues:

- Historically, 70% of the budget is spent by September, necessitating supplementary grants.

- Average of ₹15,000–₹25,000 crore remains in pending wage liabilities every year.

- Roughly 20% of next year’s funds are diverted just to clear last year’s dues.

Judicial Oversight:

- Swaraj Abhiyan v. Union of India (2016):

Supreme Court emphasized that budgetary constraints cannot be a reason to deny legally mandated employment or wage payments under MGNREGS.

Broader Impact on Rural Governance:

- Loss of credibility in employment guarantees

- Increased rural distress in periods of crop failure or climate shocks

- Widening rural-urban inequality

- Possible unrest due to non-payment or delayed payments

Summary:

The Centre’s move to cap MGNREGS expenditure in the first half of FY 2025–26 contradicts the scheme’s demand-based and legal-entitlement structure. While aimed at improving fiscal discipline, it could compromise rural livelihoods, delay wages, and violate legal rights. Unless clarified, this cap may result in widespread implementation issues, further burdening an already strained rural employment system.

Exam Connect – Possible Questions

Prelims

- The Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) provides which of the following?

A. 150 days of employment in rural areas

B. 100 days of legally guaranteed employment

C. Only post-monsoon employment for farmers

D. Rural employment for urban migrants only

Answer: B. 100 days of legally guaranteed employment - What is the purpose of the Monthly/Quarterly Expenditure Plan (MEP/QEP) applied to MGNREGS in FY 2025–26?

A. To improve employment guarantees

B. To reduce the scheme to a pilot project

C. To regulate government cash flow and spending

D. To merge it with urban employment schemes

Answer: C. To regulate government cash flow and spending - Which Supreme Court case emphasized that fiscal constraints cannot justify failure to implement MGNREGS obligations?

A. Kesavananda Bharati v. Union of India

B. Minerva Mills v. Union of India

C. Swaraj Abhiyan v. Union of India

D. Olga Tellis v. Bombay Municipal Corporation

Answer: C. Swaraj Abhiyan v. Union of India

Mains

- Critically examine the implications of imposing spending caps on MGNREGS for the governance of rural employment.

- Discuss the legal and ethical dimensions involved in restricting expenditure on statutory schemes like MGNREGS.

- How do financial control mechanisms like MEP/QEP interact with the rights-based nature of welfare schemes? Use MGNREGS as a case study.

3. Centre Caps MGNREGS Spending – Governance

Why in News?

The Union Finance Ministry has capped expenditure under the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS) to 60% of its total annual budget for the first half of FY 2025–26. This marks a shift from the program’s demand-driven nature, drawing concern from economists and social policy experts.

What is MGNREGS?

- Established under: MGNREGA Act, 2005

- Type: Centrally Sponsored Scheme with legal entitlements

- Objective: To provide at least 100 days of guaranteed wage employment per financial year to rural households willing to do unskilled manual work

Historical Background:

- Origins:

- Inspired by Maharashtra’s Employment Guarantee Scheme (1965)

- National-level proposal first made in 1991 by PM P. V. Narasimha Rao

- Significance:

First law in India to legally guarantee the right to work, backed by compensation for non-compliance

Key Legal and Operational Features of MGNREGS:

| Feature | Details |

|---|---|

| Legal Entitlement | Not a welfare scheme—citizens have a statutory right to demand work |

| Eligibility | Any adult rural resident (18+) |

| Job Offer Timeframe | Must be offered work within 15 days of demand |

| Work Proximity | Must be within 5 km of applicant’s residence |

| Wage Delays | Attract automatic compensation |

| Unemployment Allowance | Payable by State if no work is provided |

| Women’s Participation | At least one-third of beneficiaries must be women |

| Social Audits | Mandated for transparency and accountability |

| Decentralised Implementation | Led by Gram Panchayats, supported by Block and State levels |

| Project Types | Focused on rural infrastructure: ponds, roads, canals, plantations, etc. |

Why Has the Government Imposed the Cap?

- To prevent “front-loading” of funds—i.e., excessive use of the budget in the first half of the year

- To align MGNREGS with the Monthly/Quarterly Expenditure Plan (MEP/QEP), which manages cash flow across ministries

- Historically, over 70% of MGNREGS funds are used by September, creating mid-year fund shortages

Current Status (As of June 2025):

- 28% of the annual budget already spent

- ₹9,200 crore in unpaid dues carried over from FY 2024–25

Issues and Criticism:

- Undermining Demand-Driven Design:

Capping spending conflicts with the scheme’s legal framework that mandates responsive government action based on citizen demand - Potential Legal Violations:

- Right to work is enforceable under the MGNREGA Act

- Courts have rejected fiscal constraints as a valid excuse (Swaraj Abhiyan v. Union of India, 2016)

- Operational Consequences:

- Delays in wage payments

- Rejection of employment requests

- Erosion of public trust in the scheme

Summary:

The recent decision to limit MGNREGS spending to 60% of its annual allocation in the first half of FY 2025–26 is aimed at preventing early fund exhaustion. However, it raises serious concerns about the scheme’s legal integrity, responsiveness to rural distress, and ability to meet constitutional obligations. With pending dues and rising rural unemployment, the move may violate citizens’ right to work, making it a critical governance issue.

Exam Connect – Possible Questions

Prelims

- Which of the following is not a feature of MGNREGS?

A. Demand-driven legal entitlement

B. Wage payment within 30 days

C. No limit on annual budget usage

D. Unemployment allowance for non-provision of work

Answer: C. No limit on annual budget usage - Which case reinforced the legal obligation of the State to fulfill MGNREGS guarantees despite fiscal constraints?

A. Minerva Mills v. Union of India

B. Kesavananda Bharati v. Union of India

C. Swaraj Abhiyan v. Union of India

D. Olga Tellis v. Bombay Municipal Corporation

Answer: C. Swaraj Abhiyan v. Union of India - What proportion of MGNREGS beneficiaries must be women?

A. One-half

B. One-fourth

C. One-third

D. Two-thirds

Answer: C. One-third

Mains

- Discuss the impact of the 2025 MGNREGS spending cap on rural employment and governance in India.

- MGNREGS is a legal entitlement scheme. Evaluate the constitutional and operational challenges in limiting its funding.

- How do budgetary controls like the MEP/QEP affect the effectiveness of rights-based welfare schemes like MGNREGS?

4. Strategic Convergence and Defence Industrial Cooperation between India and the EU – International Relations

Why in News?

The European Commission’s Joint White Paper on European Defence Readiness 2030 outlines a renewed strategic approach towards building the EU’s defence capabilities. This policy shift, spurred by the ongoing Russia–Ukraine conflict and rising trans-Atlantic security challenges, has created new defence-industrial cooperation opportunities for India, including exports, R&D partnerships, and regulatory alignment.

Background and Global Context:

- The EU is striving for strategic autonomy in defence while maintaining strong ties with NATO and the US.

- A targeted defence budget increase to 1.5% of GDP, amounting to €800 billion over the next 4 years, is proposed.

- The White Paper prioritizes seven focus areas, including:

- Air defence systems

- Military mobility

- Cybersecurity

- Artificial Intelligence (AI)

- Dual-use technologies

- Space security

- Interoperability with NATO standards

India–EU Strategic Alignment:

Opportunities for India:

- Defence Exports

- India’s defence exports reached ₹23,622 crore (~$2.76 billion)

- Potential for exports of advanced artillery, UAVs, and NATO-compliant systems

- Joint Research and Development (R&D)

- Prospects for collaborative innovation in AI, cyber warfare, and surveillance tech

- Integration with European SMEs and defence start-ups

- Security and Defence Partnership (SDP):

- EU proposes formal SDP frameworks with India, Australia, and Japan

- India can become a long-term security partner in the Indo-Pacific and Eurasian regions

- Space & Cybersecurity Engagement:

- Collaborative missions in space technology, satellite surveillance, and cyber defence architecture

- Participation in infrastructure and military mobility projects across EU territories

Regulatory and Strategic Considerations:

- India must align with EU’s evolving regulatory frameworks and procurement protocols

- Need for cross-certification of defence products and compliance with EU quality standards

- Strengthening institutional cooperation via:

- India–EU Defence Consultations

- Bilateral dialogues on export controls and dual-use goods

- Joint task forces in technology transfer

Strategic Implications for India:

- Strengthens Make in India and Aatmanirbhar Bharat in defence

- Diversifies India’s defence partnerships beyond traditional allies (e.g., Russia, Israel, US)

- Enhances India’s diplomatic weight in European security affairs

- Provides access to cutting-edge defence markets and innovation ecosystems

Summary:

The European Commission’s White Paper on Defence Readiness 2030 highlights a strategic convergence between India and the EU. With the EU seeking stronger industrial and strategic partnerships amid geopolitical shifts, India finds itself in a prime position to expand defence exports, engage in joint R&D, and reinforce its role as a key Indo-Pacific security partner. This development signals a new phase in India–EU bilateral ties, balancing strategic autonomy with technological interdependence.

Exam Connect – Possible Questions

Prelims

- Which of the following is not a priority area under the EU’s Defence Readiness 2030 White Paper?

A. Military mobility

B. Artificial Intelligence

C. Renewable energy subsidies

D. Air defence systems

Answer: C. Renewable energy subsidies - India’s defence exports in 2024–25 reached approximately:

A. ₹10,000 crore

B. ₹23,622 crore

C. ₹30,000 crore

D. ₹15,540 crore

Answer: B. ₹23,622 crore - Which of the following regions is India expected to partner with the EU under the proposed SDP framework?

A. Arctic

B. Indo-Pacific

C. Sub-Saharan Africa

D. South America

Answer: B. Indo-Pacific

Mains

- Discuss the strategic and economic implications of the proposed defence industrial cooperation between India and the European Union.

- How can India leverage the EU’s Defence Readiness 2030 initiative to enhance its defence exports and self-reliance goals?

- Critically examine the role of India–EU defence ties in strengthening India’s strategic autonomy and global positioning.

5. What is the G7 Grouping? – International Relations

Why in News?

The Prime Minister of India recently visited Canada to participate in the G7 Summit at the invitation of Canadian PM Mark Carney. This participation reflects India’s increasing engagement with global governance platforms despite not being a formal G7 member.

What is the G7 Grouping?

- The Group of Seven (G7) is an informal forum of seven of the world’s most advanced and industrialized economies.

- Current Members:

- Canada

- France

- Germany

- Italy

- Japan

- United Kingdom (UK)

- United States (USA)

- The European Union (EU) also participates but is not a formal member and does not hold the presidency.

Historical Background:

- Founded: 1975

- Origin: Formed in response to the 1973 oil crisis and global financial instability.

- G8 Phase:

- Russia joined in 1998, transforming it into the G8.

- Russia was suspended in 2014 after the annexation of Crimea; group reverted to G7 format.

Key Functions and Agenda:

| Area | Description |

|---|---|

| Economic Policy | Originally focused on macroeconomic coordination among major economies |

| Climate Change & Energy | Leading discussions on carbon neutrality, green finance, and energy security |

| Global Health | Played a crucial role in global pandemic responses and health security frameworks |

| Security & Geopolitics | Takes stances on issues like Ukraine war, Indo-Pacific strategy, terrorism |

| Trade & Development | Shapes global trade policies, digital economy rules, and aid commitments |

Governance Structure:

- No permanent secretariat

- Rotating Presidency – Changes annually among the 7 members

- The Presidency hosts the annual summit, sets the agenda, and issues a joint communiqué

- Decisions are consensus-based and non-binding, but have significant political influence

India’s Engagement with the G7:

- Though not a member, India is often invited as a guest country to summits.

- Participation highlights India’s global economic importance and role as a democratic power in the Global South.

- Recent themes of India’s engagement include:

- Climate diplomacy

- Digital public infrastructure (DPI)

- Supply chain resilience

- Indo-Pacific security cooperation

Summary:

The G7 is an informal yet powerful coalition of the world’s most advanced economies that addresses key global challenges. While not a formal member, India’s recurring invitation to the G7 summits underscores its growing global influence, particularly in areas like climate policy, digital governance, and geopolitical balance. The 2025 summit in Canada serves as a key platform for India to deepen engagement with Western democracies and advocate for equitable global development.

Exam Connect – Possible Questions

Prelims

- Which of the following is not a member of the G7 grouping?

A. France

B. Russia

C. Japan

D. Canada

Answer: B. Russia - What is true about the G7 group?

A. It has a permanent secretariat

B. India is a full member

C. It is an informal group of advanced economies

D. The EU holds the presidency in alternate years

Answer: C. It is an informal group of advanced economies - Which of the following statements is correct?

A. The G7 was created after the global financial crisis of 2008

B. G7 summits result in legally binding agreements

C. The G7 was briefly known as G8 after including Russia

D. G7 includes China and Brazil as observers

Answer: C. The G7 was briefly known as G8 after including Russia

Mains

- What is the significance of India’s participation in G7 summits? Discuss the strategic and diplomatic advantages of engaging with informal global groupings.

- Evaluate the relevance of the G7 in the 21st-century global order. How does its agenda influence developing countries like India?

- Discuss the limitations and opportunities for India in aligning with the G7 framework while maintaining its leadership role in the Global South.

6. What is the SCORES Portal? – Economy

Why in News?

The Securities and Exchange Board of India (SEBI) recently announced that 4,493 investor complaints were resolved in a single month through its online grievance redressal platform — SCORES (SEBI Complaints Redress System). This highlights the growing efficiency and relevance of the platform in protecting investor interests in India’s capital markets.

What is SCORES?

- Full Form: SEBI Complaints Redress System

- Launched: 2011

- Purpose: To provide an integrated online platform for investors to lodge, track, and resolve complaints against:

- Listed companies

- SEBI-registered market intermediaries (e.g., brokers, mutual funds, etc.)

How Does SCORES Work?

| Feature | Description |

|---|---|

| Filing Complaints | Investors can file complaints online or submit them physically at SEBI offices |

| SCORES 2.0 (Upgraded System) | Auto-assigns complaints to relevant entities for quicker resolution |

| Action Taken Report (ATR) | Entities must respond with an ATR within 21 days |

| First Level Review | Investors can request a review within 15 days if dissatisfied |

| Second Level Review | Further escalation is possible if grievance remains unresolved |

| ODR Option | Complaints may be diverted to Online Dispute Resolution (ODR) if mutually agreed |

Key Benefits of the SCORES Portal:

- Time-bound redressal: Faster grievance handling with automated timelines

- Transparency: Allows real-time tracking of complaint status

- Accessibility: Complaints can be submitted digitally or physically

- Accountability: Mandates a response from listed companies and intermediaries

- Consumer Empowerment: Enables retail investors to seek legal and regulatory remedies

Recent Trends & Stats:

- In the latest month reported (May/June 2025), 4,493 complaints were resolved

- Increasing usage shows improved investor awareness and regulatory responsiveness

Summary:

The SCORES portal is SEBI’s flagship initiative to make investor grievance redressal faster, transparent, and accountable. With upgrades like SCORES 2.0, it now includes automated complaint routing and review mechanisms. Its efficiency in handling thousands of complaints monthly demonstrates SEBI’s commitment to building trust in India’s financial markets by safeguarding investor rights.

Exam Connect – Possible Questions

Prelims

- The SCORES platform is related to which of the following?

A. Tax filing

B. Banking regulation

C. Investor grievance redressal

D. Insurance claim processing

Answer: C. Investor grievance redressal - Which of the following statements about the SCORES 2.0 platform is correct?

A. It allows anonymous complaints

B. It replaces SEBI’s regulatory authority

C. It auto-routes complaints to the relevant entities

D. It permits complaints only from financial institutions

Answer: C. It auto-routes complaints to the relevant entities - What is the time limit for listed entities to submit an Action Taken Report (ATR) under SCORES?

A. 7 days

B. 15 days

C. 21 days

D. 30 days

Answer: C. 21 days

Mains

- Discuss the role of digital platforms like SCORES in strengthening investor protection in India’s capital markets.

- Evaluate the effectiveness of SEBI’s SCORES initiative in promoting transparency and accountability in financial regulation.

- How can grievance redress mechanisms in financial markets support broader economic confidence and investor participation in India?

7. India Needs a Sincere Aircraft Accident Investigation Framework – Governance

Why in News?

Recent aviation accidents have exposed weaknesses in India’s aircraft accident investigation system, especially highlighting concerns over the autonomy, credibility, and effectiveness of the Aircraft Accident Investigation Bureau (AAIB). Experts and former inquiry committees have called for urgent reform in how India handles aviation safety oversight.

What is the Aircraft Accident Investigation Bureau (AAIB)?

- Established: 2012

- Under: Ministry of Civil Aviation (MoCA)

- Purpose: To investigate civil aircraft accidents and incidents in accordance with International Civil Aviation Organization (ICAO) standards

- Mandate: Find factual causes—not fix blame—and make safety recommendations to prevent future occurrences

Key Problems Identified:

| Issue | Description |

|---|---|

| Lack of Autonomy | AAIB operates under MoCA, which also regulates airlines, leading to a conflict of interest |

| Reactive System | Investigations often occur after accidents, with little focus on prevention and systemic reform |

| Ignored Recommendations | Key insights from reports like the 1997 Seth Committee Report have been overlooked |

| Contradictory & Incomplete Reports | Some accident investigations have yielded inconsistent findings, damaging public trust |

| Misuse in Legal Settings | Investigations often attribute blame to pilots while ignoring systemic lapses, influencing court proceedings unfairly |

| Lack of Public Transparency | Victims’ families are often not given satisfactory explanations, and reports are not always made public |

Case Example – Seth Committee Report (1997):

- Highlighted institutional failures, need for independent probes, and transparent data sharing

- Recommendations were never fully implemented

- Similar problems persist today, including opaque procedures and lack of oversight

Global Best Practices:

- In countries like the United States (NTSB) and United Kingdom (AAIB UK), investigation agencies are statutorily independent

- These bodies report directly to the parliament or legislature, not to the aviation ministry

Needed Reforms:

- Statutory Autonomy for AAIB – Separate from MoCA, with independent funding and direct reporting lines

- Public Access to Reports – Make investigation reports and safety recommendations open and auditable

- Data-Driven Prevention – Build a real-time, AI-supported database for tracking near misses and risk indicators

- Non-Punitive Safety Culture – Shift from blame assignment to systemic improvement

- Victim-Centric Communication – Provide transparent updates and credible answers to affected families

Summary:

India’s current aircraft accident investigation framework suffers from institutional conflict, lack of transparency, and a reactive mindset. The AAIB, though tasked with independent inquiries, functions under the Ministry of Civil Aviation, compromising its objectivity. Ignoring past reform proposals and failing to adopt global best practices have worsened public trust. A sincere reform, ensuring autonomy, accountability, and victim-focused transparency, is critical for aviation safety and governance integrity.

Exam Connect – Possible Questions

Prelims

- Which body investigates civil aviation accidents in India?

A. Directorate General of Civil Aviation (DGCA)

B. National Disaster Management Authority

C. Aircraft Accident Investigation Bureau (AAIB)

D. Indian Air Safety Authority

Answer: C. Aircraft Accident Investigation Bureau (AAIB) - The Aircraft Accident Investigation Bureau (AAIB) in India functions under:

A. Ministry of Defence

B. Ministry of Home Affairs

C. Prime Minister’s Office

D. Ministry of Civil Aviation

Answer: D. Ministry of Civil Aviation - Which of the following statements is true about India’s AAIB?

A. It is a constitutional body

B. It reports directly to the Parliament

C. It is an autonomous statutory body

D. It lacks statutory autonomy and functions under an executive ministry

Answer: D. It lacks statutory autonomy and functions under an executive ministry

Mains

- India’s aircraft accident investigation mechanism has often been criticized for lacking autonomy and transparency. Discuss the structural issues and suggest reforms.

- Examine the conflict of interest in India’s aviation regulatory framework and its impact on aviation safety.

- How can India adopt global best practices to reform its aircraft accident investigation system and rebuild public trust?

8. Ahmedabad Air India Crash – The Role of DNA in Victim Identification – Science & Technology

Why in News?

Following the recent Air India Boeing 787 crash in Ahmedabad, authorities are relying on DNA analysis to identify the victims. With physical features destroyed due to the intensity of the crash, DNA profiling has emerged as the most accurate and dependable method for identification. DNA samples from family members are being used to match with the remains, enabling identification and providing closure to families.

What is DNA and Why is it Useful for Identification?

- DNA (Deoxyribonucleic Acid): The hereditary material found in almost every cell of the human body.

- Structure: A double helix made of repeating units called nucleotides, each consisting of:

- A sugar

- A phosphate group

- One of four nitrogenous bases: Adenine (A), Thymine (T), Cytosine (C), Guanine (G)

- Uniqueness: Except for identical twins, every individual has a unique DNA profile, making DNA the gold standard for forensic identification.

Types and Locations of DNA in the Body:

| Type | Found In | Use in Forensics |

|---|---|---|

| Nuclear DNA | Cell nucleus | Unique to individuals; used in STR analysis |

| Mitochondrial DNA (mtDNA) | Mitochondria | Inherited maternally; useful when nuclear DNA is degraded |

| Y-chromosomal DNA | Found only in males | Used for male lineage identification |

Methods of DNA Analysis in Disaster Victim Identification (DVI):

| Method | Use Case |

|---|---|

| STR (Short Tandem Repeat) Analysis | Primary method; requires high-quality nuclear DNA |

| mtDNA Analysis | Effective when remains are degraded; matched with maternal relatives |

| Y-Chromosome Analysis | Identifies male victims; matches with paternal lineage |

| SNP (Single Nucleotide Polymorphism) Analysis | Used in highly degraded samples; less precise than STRs but helpful when other methods fail |

Challenges in DNA-Based Identification:

- Decomposition and Fire Damage: Heat and moisture can destroy DNA

- Contamination: Mishandling or environmental exposure can compromise samples

- Resource Requirements: Testing is technically intensive, costly, and time-consuming

- Sample Collection: Difficult to obtain reliable reference samples without close biological relatives

Preservation of DNA Samples:

| Tissue Type | Best Preservation Method |

|---|---|

| Soft Tissue | Store at –20°C or in 95% ethanol |

| Bone/Tooth | Highly durable; preferred in mass disasters |

| Blood/Saliva Samples (from relatives) | Collected for matching purposes |

Importance of Reference Samples:

- DNA from parents, children, or siblings is critical for cross-matching

- Enables kinship analysis, particularly when direct victim samples are damaged

- Government agencies often set up family assistance centers for organized collection

Summary:

In the aftermath of disasters like the Ahmedabad Air India crash, DNA profiling remains the most scientifically reliable tool for victim identification. Techniques like STR and mtDNA analysis help authorities match remains with relatives, even when physical identification is impossible. Though the process faces challenges—like degradation, contamination, and time constraints—it is essential for forensic accuracy, legal closure, and human dignity.

Exam Connect – Possible Questions

Prelims

- Which of the following methods is used when nuclear DNA is too degraded to analyze?

A. STR Analysis

B. mtDNA Analysis

C. Y-Chromosome Analysis

D. RNA Sequencing

Answer: B. mtDNA Analysis - What makes mitochondrial DNA particularly useful in victim identification?

A. It mutates rapidly

B. It is inherited from both parents

C. It is present in multiple copies and resists degradation

D. It is unique to males only

Answer: C. It is present in multiple copies and resists degradation

3. Which of the following bases is not found in DNA?

A. Thymine

B. Uracil

C. Adenine

D. Cytosine

Answer: B. Uracil

Mains

- Discuss the role of DNA technology in disaster victim identification. How does it ensure both scientific accuracy and human dignity?

- Examine the ethical, technical, and logistical challenges associated with the use of DNA profiling in mass disaster events.

- How can India improve its forensic infrastructure to ensure faster and more reliable identification in aviation or mass-casualty incidents?