The Organization for Economic Co-operation and Development (OECD) finalized a landmark agreement to subject multinational enterprises (MNEs) to a minimum 15% tax from 2023. In a digitalized and globalized world economy, this deal brings in a fundamental reform in international tax rules.

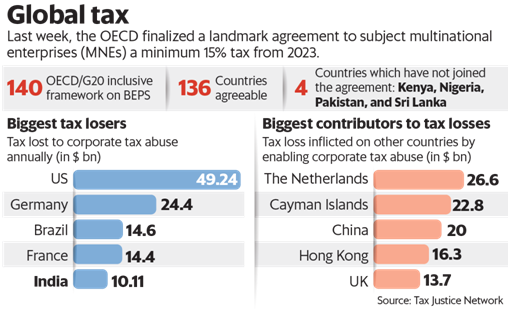

- A total of 136 countries (out of the 140 members of the OECD/G20 Inclusive Framework on BEPS), joined the “Statement on the Two-Pillar Solution to Address the Tax Challenges Arising from the Digitalization of the Economy”.

- It is supported by all OECD and G20 countries. Four countries – Kenya, Nigeria, Pakistan and Sri Lanka – have not yet joined the agreement.

Aim

- The global minimum tax agreement does not seek to eliminate tax competition, but puts multilaterally agreed limitations on it, and will see countries collect around USD 150 billion in new revenues annually.

- This will help reallocate profits of over $125 billion from over 100 large MNEs to help ensure companies pay a fair share of tax in the countries they operate in.

‘Two Pillar’ solution

1) Pillar One

Pillar One will ensure a fairer distribution of profits and taxing rights among countries with respect to the largest and most profitable multinational enterprises. It will re-allocate some taxing rights over MNEs from their home countries to the markets where they have business activities and earn profits, regardless of whether firms have a physical presence there. Specifically, multinational enterprises with global sales above EUR 20 billion and profitability above 10% – that can be considered as the winners of globalisation – will be covered by the new rules, with 25% of profit above the 10% threshold to be reallocated to market jurisdictions. Developing country revenue gains are expected to be greater than those in more advanced economies, as a proportion of existing revenues.

2) Pillar Two

Pillar Two introduces a global minimum corporate tax rate set at 15%. The new minimum tax rate will apply to companies with revenue above EUR 750 million and is estimated to generate around USD 150 billion in additional global tax revenues annually. Further benefits will also arise from the stabilisation of the international tax system and the increased tax certainty for taxpayers and tax administrations.

Impact on India

- India has also joined this historic agreement. The tax deal will mean removal of existing digital service taxes and other unilateral measures by 2023.

- India will need to withdraw the equalization levy that was introduced in 2016. This levy was aimed at taxing foreign firms that have a substantial client base in the country, but were billing via their offshore units.

- Experts believe the tax would be advantageous for India as the effective domestic tax rate is above the threshold and India, being a large potential market, would continue to attract foreign investments.

Sources: https://www.livemint.com/politics/news/whats-the-global-minimum-tax-deal-all-about-11634061524403.html, https://indianexpress.com/article/explained/global-minimum-tax-deal-explained-7561867/, https://www.oecd.org/tax/international-community-strikes-a-ground-breaking-tax-deal-for-the-digital-age.htm